VIX witnessed a spike reversal last week, before coming under massive downward pressure this week, helping equities. Equity bulls could receive further help should Friday’s CPI behave.

It turns out VIX flashed a spike reversal last week.

On Friday, it jumped as high as 35.32 intraday. This was the highest print since January this year and represented higher highs; the index retreated from 24.74 in August and 28.79 in September. But volatility bulls were unable to hang on to the session’s intraday gains, closing at 30.67. The resulting weekly candle sported a long upper shadow. In the past, candles with similar shapes caused volatility to come under pressure in the subsequent sessions/weeks (arrows in Chart 1).

With two sessions remaining this week, VIX has shed 10.77 points to 19.90. Incidentally, the inability to hang on to last Friday’s highs also meant the index remained trapped in a months-long descending channel. The 50- and 200-day are right underneath. A rising trend line from late 2017 extends to 15. As things stand, this is the worse-case scenario for volatility bulls.

Seasonally, this time of the year tends to favor equity bulls.

From the November 22 record high of 4744 through last Friday’s low of 4495, the S&P 500 quickly shed 5.2 percent. This was enough for the buy-the-dips crowd to step in. The 50-day was slightly breached last week. For well over a year now, the average has consistently attracted bids. This time was no exception.

The large-cap index has rallied for three consecutive sessions and is up 3.6 percent week-to-date, and is merely 0.9 percent from last month’s high. As things stand, bulls are looking for a reason to push prices higher. November’s consumer inflation data due out Friday morning could prove to be important in this regard.

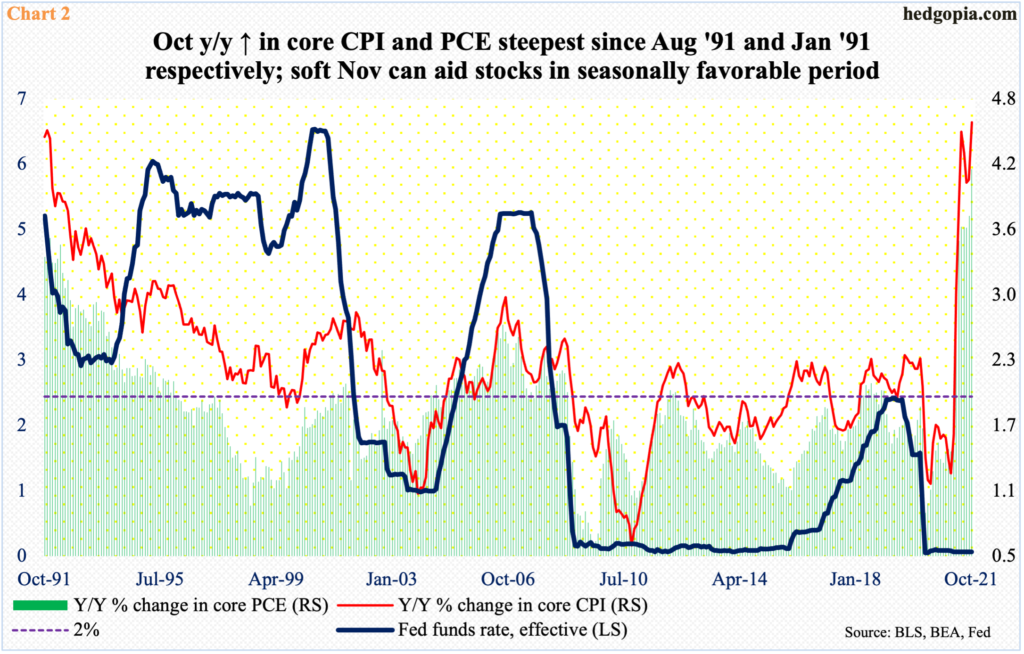

The consumer price index (CPI) has sustained higher for months now. On a core basis, inflation jumped 4.6 percent in the 12 months to October – the steepest pace since August 1991. Also in the 12 months to October, core PCE (personal consumption expenditures), which is the Federal Reserve’s favorite measure of inflation, spiked 4.1 percent; this was the highest rate of price rise since January 1991. As recently as February this year, these two metrics were rising at a 1.3 percent and 1.5 percent rate respectively (Chart 2).

The persistency of inflation forced Jerome Powell, Fed chair, to admit last week that he would no longer use the word “transitory” to describe inflation. He also floated the idea of accelerated taper of bond purchases, which at the current pace of $15 billion a month is set to complete by the middle of next year. This would also suggest rates begin to lift off sooner than the Fed previously expected. The fed funds rate remains zero bound since March-April last year.

Amid this hawkish tone, equities likely come under upward pressure if inflation on Friday either comes in softer than the consensus or markets perceive it is headed in the right direction.

Thanks for reading!