Are things really bad out there?

Without a doubt, there is no shortage of things to worry about. From slowdown in China to volatility in emerging markets to continued deceleration in the global economy to the Fed possibly committing a policy error by getting on a tightening cycle… it runs the gamut.

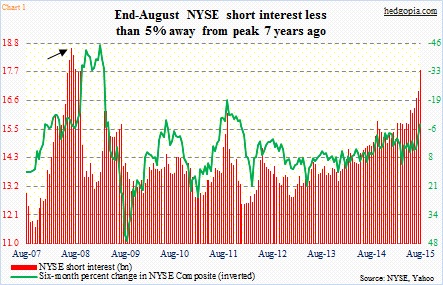

But is it comparable to the days and weeks leading up to the financial crisis? You would get that impression if you look at Chart 1. As of August 31st, NYSE short interest stood at 17.77 billion – less than five percent away from the peak seven years ago (arrow in the chart). The world was in the midst of a crisis back then.

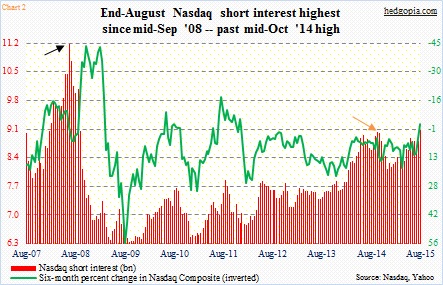

Short interest on the Nasdaq Composite is no different. Directionally, it has been trending higher – 9.08 billion at the end of August – although there is a ways to go before it catches up to the September 2008 high (black arrow in Chart 2), some 23 percent away. During the financial crisis, it started rising at the end of October 2007 and kept rising, until it crested 11 months later.

So the question is, would the red bars on the right side in Charts 1 and 2 in due course begin to mirror those on the left or would they begin to recede as has happened multiple times in the current bull market? The latest contraction (orange arrow in Chart 2) took place as stocks bottomed in the middle of October last year after a nearly 10-percent drop in the S&P 500 Index. Nasdaq short interest dropped from 9.02 billion to 8.12 billion by the end of December.

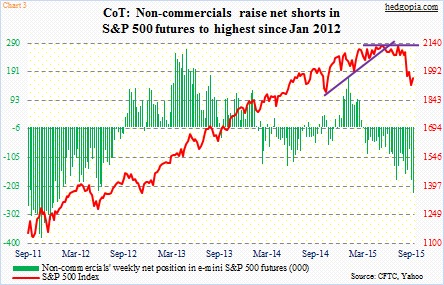

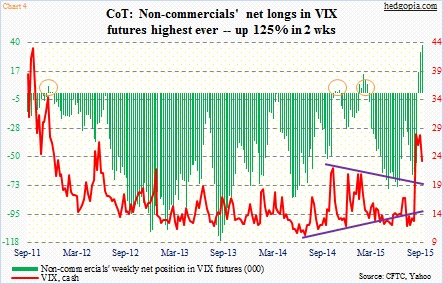

As to the possible path short interest might take going forward, it is not even worth a guess. But a few other things are worth pointing out. The buildup is coming at a time when non-commercials are beginning to aggressively lean bearish – seen through how they are positioned in S&P 500 and VIX futures.

In two weeks, large speculators have increased net shorts in S&P 500 futures by 200 percent, to 226,926 contracts – the highest since January 2012 (Chart 3). These are holdings as of last Tuesday. Interestingly, in the week leading up to that the S&P 500 added 55 points, but this did not discourage these traders from adding to their net shorts. Net shorts went up 26 percent in the latest week.

It is the same trend over at VIX. In five weeks, non-commercials have gone from net shorts (-64,445) to net longs (37,925). Net longs have never been this high. Here is the interesting thing. In the past, whenever these traders have shifted from net shorts to net longs, sooner or later spot VIX has tended to peak (circles in Chart 4), which then acts as a tailwind for stocks. Indeed, when on August 24 stocks made a low and then reversed, spot VIX did the same, reversing after making a multi-year high of 53.29. Since that low, the S&P 500 is nearly 100 points higher, and VIX has been more than cut in half. Will this persist?

Bulls hope so for sure.

While the sudden rise in short interest and net shorts shows a rising level of conviction on the part of bears, this is also a great opportunity for bulls to force a squeeze – along the lines of what transpired in the wake of the mid-October 2014 bottom in stocks. Can they deliver?

There are a few differences worth pointing out between that low and now.

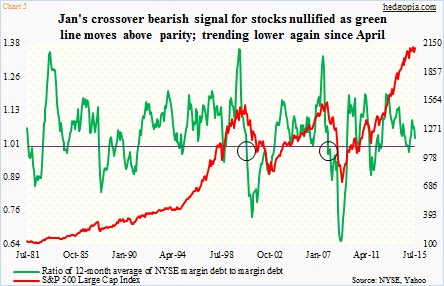

In Chart 5, the green line is a ratio of 12-month average of NYSE margin debt to margin debt. Margin debt made an all-time high of $507 billion this past April, and has since dropped to $487 billion (as of July). In recent months, the pace is decelerating. In April, it jumped $70 billion year-over-year, but slowed down to $27 billion in July. Hence the importance of the green line. In the past, whenever it drops below one, stocks suffer (circles in the chart). In January, it did cross over, but was immediately nullified as debt picked back up. In July, it dropped 3.5 percent. If August sees a similar drop – possible given the 6.3-percent drop in the S&P 500 – the ratio drops below parity again. Hence worth a close watch.

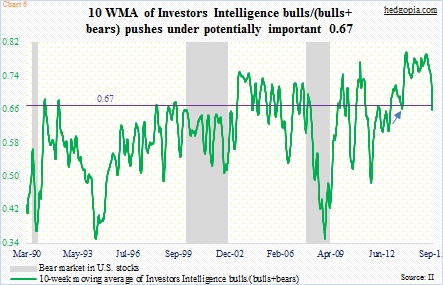

Also worth a watch is Chart 6. Last week, Investors Intelligence bulls were 25.7 percent – the lowest since December 2008. It almost feels like a washout – a total capitulation. Although bears were only 27.9 percent – nowhere near panic highs. As a result, the number of investors expecting a correction is rather large – in the 40-percent range the past six weeks. Nonetheless, the sharp drop in the number of bulls has taken a toll on the green line in the chart. It represents a 10-week moving average of bulls/(bulls+bears). There is a line drawn at 0.67 – potentially an important number, at least going back 25 years. Once the line drops below 0.67 from above, more often than not it has shown a tendency to persist. This took place last week. With that said, back in October 2013 it stayed below one for two weeks (arrow in the chart), before turning back up.

The point in all this is this. There is an amalgam of indicators that could potentially be sitting at inflection points. Hence the significance of bulls’ ability – or a lack thereof – to regroup. Should they succeed, they have such a great opportunity to squeeze the heck out of shorts. A failure can change the tone of the market – for the worse.

This at a time when flows are currently not in bulls’ favor. In the August 9th week, U.S.-based stock funds saw outflows of $16.2 billion, following $3.9 billion inflows last week (courtesy of Lipper). Funds focused on U.S. shares saw outflows of $14.3 billion, while those specializing in international shares had $1.9 billion in outflows. This can always change. Once a bottom is in place, and stocks begin to move higher, that will/can attract flows.

Speaking of buying power, corporate buybacks have been a persistent go-to source for the last several years. Corporations have been more than willing to hike/dole out dividends and buy back shares, and take on debt, if the need be. In 2014, corporate buybacks were $679 billion, up from $149 billion in 2009 (courtesy of Birinyi Associates).

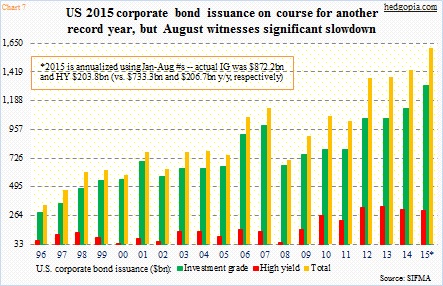

In this regard, it pays to keep a close eye on corporate debt issuance. First off, U.S. corporations are on course to issuing another record amount this year – the 6th consecutive year of north of $1 trillion (Chart 7). Year-to-August, $872.2 billion has been issued in investment-grade and $203.8 billion in high-yield. August, however, was merely $41.7 billion and $14.8 billion, respectively, versus a monthly average this year of $109 billion and $25 billion. Now it is too soon to be reading too much into this. It is just one month. Besides, August was also weak last year – $45.6 billion and $3.4 billion, in that order. Nonetheless, this is another one of those data points that need to cooperate with bulls if they are to be able to force a squeeze.

Thanks for reading!

Please keep in mind that this article was originally published yesterday (September 14th) by See It Market, where I am a contributor.