December thus far has been uncharacteristically quiet. And that is putting it nicely. U.S. stocks have failed to get seasonal traction this month. So far.

There are eight sessions remaining before the year is out. So there is hope.

Since 2008, the S&P 500 index has risen in December every single year, except for 2014 when it essentially went sideways. This year, the index is down 3.6 percent. Ditto with the Nasdaq. The Dow Industrials is down 3.3 percent, and the Russell 2000 index down a whopping 6.4 percent.

Since the September retest of August lows through early November, the S&P 500 rallied 13 percent, before going sideways to down. That is when high-yield bonds began to come under genuine pressure. Not to mention the transports.

Money is coming out of U.S.-based equity funds. For the week ended last Wednesday, $13.2 billion left (courtesy of Lipper). This follows withdrawal of $8.6 billion in the prior week. Since September 30th, $11 billion has now left these funds.

For those looking for help on the fundamental front, they are not getting much either. At least not in earnings.

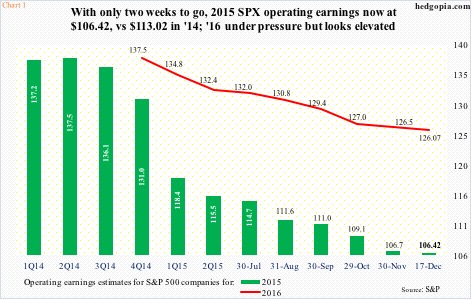

Next year’s operating earnings estimates for S&P 500 companies have been under persistent pressure since the year began – from $137.50 back then to $126.07 now (Chart 1). The irony is, they may still be too high.

Some context is in order.

At the end of the second quarter last year, 2015 estimates were $137.50. Then they began to drop – currently $106.42 – and would be down nearly six percent over 2014. Energy takes the main blame, but not the sole source behind the downward revision. For 2016 estimates to come true, several things have to go right – from acceleration in economic growth to weakening of the dollar to stability in the price of crude oil.

The way 2015 unfolded, it is tough to place too much faith in 2016 estimates. That said, this may not be the main reason why money is coming out of stocks.

As stated earlier, December tends to be a good month, and investors/traders try to position for it earlier. Should flows cooperate, the momentum continues. This year, they did not.

With this, stocks in general have been pushed down into oversold territory.

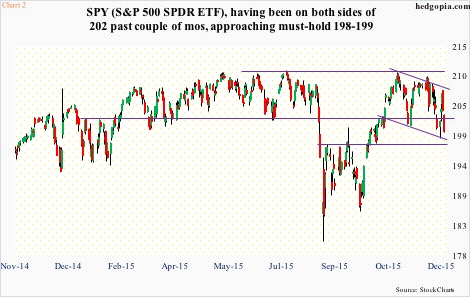

For the past month and a half, SPY, the SPDR S&P 500 ETF, has been trending within a descending channel. It is currently near the bottom end of that. This support also approximates horizontal support at $198-$199.

A week ago, SPY did drop near that support, and buyers showed up.

Post-August sell-off, the $198-$199 level proved too tough to conquer. Once it was won over early October, the ETF rallied strong (Chart 2). Hence its significance.

After the Thursday-Friday drubbing last week, SPY has once again been pushed near that level. Given how oversold it is, odds favor it catches a bid here. A failure would probably point to serious distribution in progress.

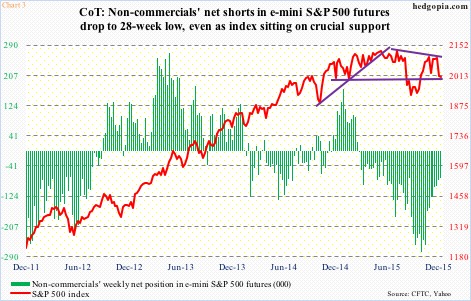

At least non-commercials are not preparing for this scenario. As of last Tuesday, they held 75,348 contracts in e-mini S&P 500 futures. This is the least since the June 2nd week (Chart 3). The index obviously is sitting on crucial support.

Assuming support holds on SPY ($200.02), out-of-the-money weekly short puts ensure either going long at a lower level or just generate some income.

Hypothetically, December 24th 199 puts bring $1.58. If put, it is a long at $197.42. In the middle of October, the ETF dipped slightly below $198 before buyers defended the afore-mentioned support.

Thanks for reading!