- After impressive two-day advance, Russell 2000 on verge of bullish golden cross

- Potential unwinding of VIX surge of early this week to act as tailwind for stocks

- In the end, rally nothing but gift for patient bears to short from higher levels

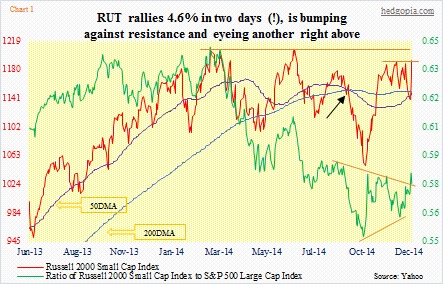

Golden cross! We will probably hear that phrase thrown around a lot as soon as today. It is the opposite of death cross, which is when the 50-day moving average crosses the 200-day from above. Technically, it is a bearish development. The Russell 2000 Small Cap Index suffered a death cross mid-September (black arrow, Chart 1), and we know what transpired soon afterwards. Now I am not suggesting this is the primary reason behind the waterfall dive small-cap stocks witnessed back then. But a lot of the technically oriented people pay close attention to this. Some even swear by it.

Why bring this up? Well, the Russell 2000 is now this close to staging a golden cross, which, as the name suggests, is considered bullish. The move the past couple of days has been nothing short of impressive/crazy/bubbly (choose as per your own view of the market), with the index having rallied nearly five percent. It is currently sitting right at one-month resistance. After this gets taken out, there is another resistance just north of 1,200, which is less than two percent away.

We are in the midst of a seasonally favorable period. Short interest remains high (on IWM, it rose five percent month-over-month to 133mn in the latest period, although down from 155mn mid-October). The past couple of days have the hallmarks of a classic squeeze. Plus, there is a sudden shift in sentiment. No one wants to be left behind. There are eight and a half sessions left before the year is out. Chasers are going to chase. They are an impatient bunch. Not unlike “patient” Chair Yellen who is in no rush to disrupt the party. If bulls cannot take advantage of this situation, then they would have left the doors wide open for another round of bear raids sooner than they would like.

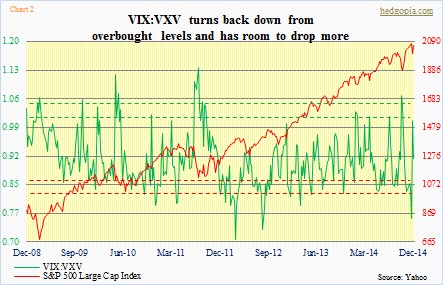

For now, it looks like the VIX wants to cooperate with the bullish thesis. On the 15th when it spiked to just below 25 intra-day, there was a level of panic that was palpable in the air; the VIX to VXV ratio surged to 1.18. That may very well be in the process of getting unwound. The ratio has further to go on the downside (Chart 2), which can result in a slow grind higher for stocks. Buyers are anticipating this. There have been back-to-back solid white candles on all major U.S. indices.

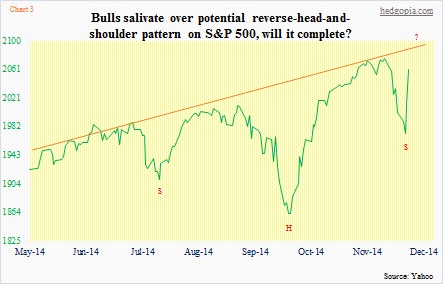

In the end, this rally would be nothing but a gift for patient bears to short from higher levels. That will be particularly true if the S&P 500 ends up completing a reverse-head-and-shoulder formation (Chart 3), potentially taking out stops and turning non-believers into believers.

The only question is how high. If these aforementioned formations get completed, things can get crazy. Quickly — kind of a self-fulfilling prophecy. We don’t know if it will come to pass. Best course of action: wait and watch.