The usual middle-of-the-road approach. Federal Reserve chair Janet Yellen’s Humphrey Hawkins testimony to the Senate yesterday, that is. (She appears before the House later today.)

There were no hints as to if she was ready to vote for a rate hike in the upcoming March 14-15 FOMC meeting. In the January 31-February 1 meeting, rates were left unchanged to a target range of ½ to ¾ percent, with no indication if March was in play.

No hike in March means six more scheduled meetings this year for the dot plot’s projection late last year of three hikes this year to come true. That is one hike every other meeting – not impossible but less feasible considering that the current FOMC keeps looking for reasons not to hike.

Meantime, should economic data begin to decelerate, it is a no-brainer. Markets can safely bid adieu to three hikes. They currently expect two anyway.

In recent months, U.S. economic data has firmed up a tad. Even assuming the current trajectory is maintained, the Fed is in a position to pick and choose.

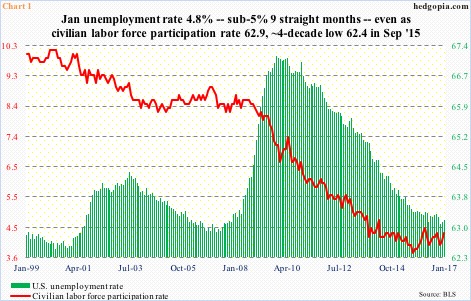

Chart 1 plots the U.S. unemployment rate with the civilian labor force participation rate. The former dropped from 10 percent in October 2009 to 4.6 percent last November, before inching up to 4.8 percent in January. This is one side of the story.

Between June 2009 (when Great Recession ended) and December 2016, the ‘not in labor force’ category rose from 80.9 million to 95.1 million (January was 94.4 million). The civilian labor force participation rate dropped from 65.7 percent in June 2009 to 62.4 percent in September 2015 – nearly four-decade low. January stood at 62.9 percent. This is the other side of the story, and the Fed would like this to change, if at all possible.

The low unemployment rate calls for a more aggressive Fed, even as the low participation rate gives them leeway.

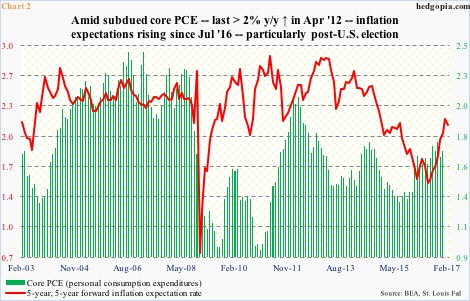

Or take a look at Chart 2. It pits core PCE (personal consumption expenditures) – the Fed’s favorite measure of inflation – with inflation expectations. The former remains suppressed. The last time core PCE was north of two percent was in April 2009.

That said, inflation expectations, represented by the five-year, five-year forward inflation expectation rate, has been rising – from 1.41 percent on July 5 last year to 1.89 percent on November 8 (election day) to 2.22 percent on January 26. It stood at 2.13 percent this Monday.

Once again, the Fed has a luxury of citing core PCE if it wants to be easy or expectations if it wants to be tight.

Markets are focused on what might happen this year, but the real story lies – or begins – next year.

There are two existing vacancies in the seven-member Board of Governors (vacant since 2014 when Jeremy Stein and Sarah Bloom Raskin left). Daniel Tarullo just said he would be leaving this April. Ms. Yellen’s term as chair expires February 3 next year. Vice-chairman Stanley Fischer’s term ends June 12 next year. As members of the Board, these two can stay until January 2024 and January 2020, respectively. It is conceivable they will retire next year.

Thus, President Trump will have an opportunity to appoint as many as five out of 12-member FOMC! Apart from seven Board members, the FOMC consists of New York Fed president and four of the remaining 11 Reserve Bank presidents, who serve one-year terms on a rotating basis. (This year, Chicago, Dallas, Minneapolis, and Philadelphia are the voting four.)

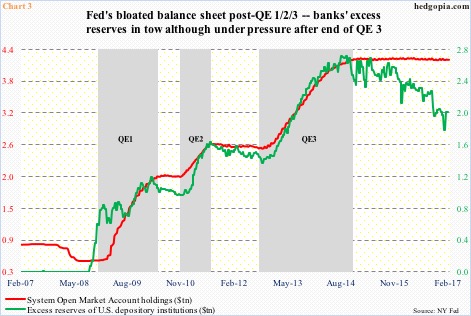

There you have it. Five out of 12 makes sure the FOMC next year will look a whole lot different. One thing is certain. The new Fed will be inheriting a bloated balance sheet (Chart 3).

During campaign, Mr. Trump was critical of the Fed’s easy money policy. This would suggest his picks would lean hawkish. A tighter monetary policy right from the word go would not only ensure room for higher fiscal spending now but also fill the monetary quiver with arrows so the Fed can ease later.

With that said, Mr. Trump also wants jobs, wants to revive manufacturing, and improve trade. A tighter Fed does not help in this endeavor. Not to mention he, along with Treasury Secretary Steven Mnuchin, have already voiced concerns about a strong dollar.

Depending on what kind of FOMC we get will have repercussions for a whole host of assets, not the least of which are equities, which in particular are the least bit prepared for a hawkish Fed.

Thanks for reading!