- VIX action yesterday constructive for equity bulls

- Medium- to long-term, equities have much more to go on the downside

- Near-term picture beginning to change, as beaten-down junk bonds and small-caps attract bids

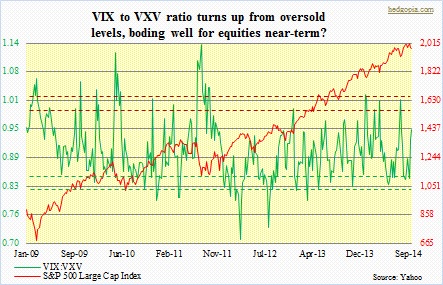

The morning gap-down in U.S. equities yesterday was bought right out of the gate. Bulls tried to genuinely build on it, but in the end, it was a choppy day. A lot of back and forth. Both the S&P 500 and the Nasdaq Composite worked hard to retake their respective 50-day average, even as the Dow Industrials saved its. The latter has not lost that average since end-July, so it is natural bids are showing up. Unless stocks really begin to come apart, that support will not crack at the very first test. Besides, these are large-caps, and that is where money for a while has been gravitating toward. Bulls face a bigger hurdle above – about 100 points from where the index (17071) closed. Unless that convincingly gets taken out, it is dangerous to get really aggressive here. Medium-term technicals are still pointing down, and they have a ways to go before the overbought conditions they are in are unwound. Medium- to long-term, equities have much more to go on the downside. That said, there is a duel in progress between short- and medium-term indicators. The former is oversold. Meanwhile, junk bonds are attracting some bids. Bulls’ willingness to step up to the plate despite the Hong Kong headlines might breathe some life to risk-on trades. Action on the VIX suggests the odds of ‘short-term’ winning out over ‘medium-term’ have risen. VIX:VXV suggests the same (bottom chart).

The morning gap-down in U.S. equities yesterday was bought right out of the gate. Bulls tried to genuinely build on it, but in the end, it was a choppy day. A lot of back and forth. Both the S&P 500 and the Nasdaq Composite worked hard to retake their respective 50-day average, even as the Dow Industrials saved its. The latter has not lost that average since end-July, so it is natural bids are showing up. Unless stocks really begin to come apart, that support will not crack at the very first test. Besides, these are large-caps, and that is where money for a while has been gravitating toward. Bulls face a bigger hurdle above – about 100 points from where the index (17071) closed. Unless that convincingly gets taken out, it is dangerous to get really aggressive here. Medium-term technicals are still pointing down, and they have a ways to go before the overbought conditions they are in are unwound. Medium- to long-term, equities have much more to go on the downside. That said, there is a duel in progress between short- and medium-term indicators. The former is oversold. Meanwhile, junk bonds are attracting some bids. Bulls’ willingness to step up to the plate despite the Hong Kong headlines might breathe some life to risk-on trades. Action on the VIX suggests the odds of ‘short-term’ winning out over ‘medium-term’ have risen. VIX:VXV suggests the same (bottom chart).

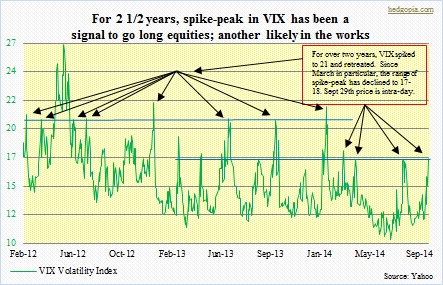

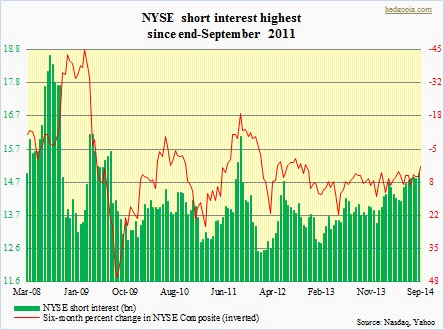

As the chart above shows, three times since March this year, the VIX has spiked, only to retreat from the 17-18 level, and that ended up lighting a match under stocks. Incidentally, prior to the current range, throughout 2012 and 2013 (except for one instance in June 2012), the fear gauge found resistance at a higher range – around 21. Resistance has shifted lower. Yesterday could be another one of those spike signals. The day’s high on the VIX was recorded in the first five minutes. Equities went the other way. It is possible short interest helped. In the latest period, NYSE short interest rose to a tad under 15bn – highest since end-September 2011 – and the Nasdaq’s rose to 8.8bn, which is two percent below a five-and-a-half-year high recorded in end-June (this year). The elevated level of short interest helps create a floor sooner as shorts scurry to cover. As pointed out yesterday, short interest on the IWM has been declining since end-July. But then again, it is possible the completion last week of the dreaded death cross on the Russell 2000 index attracted new shorts. We will find out when end-September numbers are reported. Small caps have been lagging their larger cousin since March. So they need to stabilize, especially when they are so close to a make-or-break technical level. As it stands now, so long as 110 – 108 is a must-hold – holds, near-term path of least resistance on the ETF, and for that matter equities in general, remains up, with tight stops, of course.

As the chart above shows, three times since March this year, the VIX has spiked, only to retreat from the 17-18 level, and that ended up lighting a match under stocks. Incidentally, prior to the current range, throughout 2012 and 2013 (except for one instance in June 2012), the fear gauge found resistance at a higher range – around 21. Resistance has shifted lower. Yesterday could be another one of those spike signals. The day’s high on the VIX was recorded in the first five minutes. Equities went the other way. It is possible short interest helped. In the latest period, NYSE short interest rose to a tad under 15bn – highest since end-September 2011 – and the Nasdaq’s rose to 8.8bn, which is two percent below a five-and-a-half-year high recorded in end-June (this year). The elevated level of short interest helps create a floor sooner as shorts scurry to cover. As pointed out yesterday, short interest on the IWM has been declining since end-July. But then again, it is possible the completion last week of the dreaded death cross on the Russell 2000 index attracted new shorts. We will find out when end-September numbers are reported. Small caps have been lagging their larger cousin since March. So they need to stabilize, especially when they are so close to a make-or-break technical level. As it stands now, so long as 110 – 108 is a must-hold – holds, near-term path of least resistance on the ETF, and for that matter equities in general, remains up, with tight stops, of course.