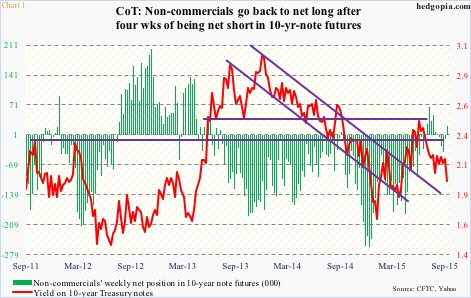

By last Tuesday, non-commercials were net long 22,490 contracts in 10-year note futures, having reversed the bearish bet they had in the prior four weeks (Chart 1). Turns out it was the right thing to do. By Tuesday, TLT, the iShares 20+ Year Treasury Bond ETF, was already up two percent for the week. The momentum continued until the first half hour into Friday’s trading session. By that time, TLT had added another two percent. Then someone flipped the switch. It was getting sold into strength.

Now it will be interesting to find out when numbers are reported this Friday if non-commercials unwound some of their longs. That might just be the right thing to do in the near-term, as Friday’s reversal may turn out to be an important one.

First of all, there was a similar reversal on August 24, the day both equities and bonds staged a massive intra-day reversal. The difference being back then TLT closed three cents lower despite having rallied two percent at one point during the session. This time around, the ETF did end up 0.6 percent, but was up as much as 1.9 percent at one time (Chart 2). Regardless, on both occasions daily conditions were in overbought territory when the reversal took place.

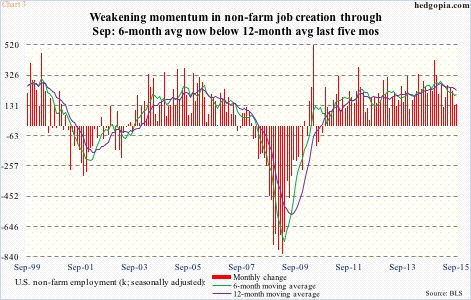

Last Friday, good news got sold (even as equities reversed early weakness on bad news). The catalyst for the gap-open (in TLT) was September’s ugly jobs report. A mere 142,000 non-farm jobs were added, with downward revisions in July and August to the tune of 81,000. Average hourly earnings of private-sector employees dropped a penny to $25.09, with annual growth stuck at 2.2 percent. The civilian labor force participation rate dropped two basis points to 62.4 – the lowest since September 1977 (not a typo!).

To be fair, jobs momentum has been waning for a while. Four out of the last seven months have come in sub-200,000. In fact, the six-month average of monthly change in non-farm employment crossed below the 12-month as early as May. The green line in Chart 3 has been below that of indigo for five consecutive months now. So it is normal for bonds to react the way they did in the first half hour last Friday. At one time, 10-year yields dropped to as low as 1.91 percent, before ending the session at 1.99 percent, down five basis points.

What is not normal is the way good news (for bonds) was sold.

From the September 16th (day one of the two-day FOMC meeting) low of $118.30 to Friday’s intra-day high of $126.21, TLT rallied 6.7 percent. Not a chump change! We are talking bonds here. So normal profit-taking can always occur. But what does it mean to be selling into strength? That from the perspective of macro news this is as bad as it gets near-term?

This week, the ISM non-manufacturing index comes out later today, and it has been coming in much stronger than its manufacturing cousin. Other releases include international trade, consumer credit, and import and export prices. None of these will have the potential to sway trading as did the jobs report last week. We also have FOMC minutes, but the markets probably know what to expect. From this perspective, it makes sense to be locking in profit in TLT for now.

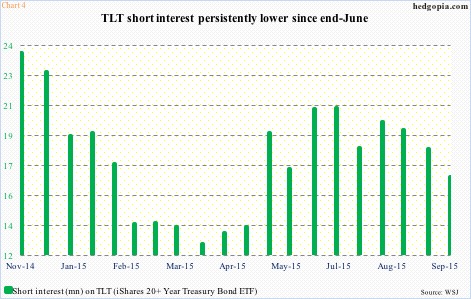

Besides, in the first half hour Friday, shorts probably got squeezed. For two hours beginning at 8:30 AM when the jobs report was published, there was panic in the air – bonds going through the roof and stocks dropping like a stone. So if shorts were forced to cover, their already thin ranks probably got thinner.

At the end of June, short interest on TLT was 20.8 million shares. That was about the time the ETF was beginning to move higher from around $114 (Chart 2). By late August, it went on to rally 12-plus percent. Short interest dropped to 18.3 million, and dropped again to 16.7 million by mid-September (Chart 4). It is possible it has dropped further.

If all this suggests TLT ($124.56) this week is likely headed lower at worst and sideways at best, there is a way to benefit from it using options. Hypothetically, weekly October 9th 125 calls fetch $0.76. These are naked calls. Options are currently pricing in a $1.93 move this week – either direction. Hence it is possible the ETF rallies at least $0.44, in which case the option will be called away, and it is an effective short at $125.76.

Thanks for reading!