Major US equity indices all peaked late January – the S&P 500 large cap index, the Dow industrials and the Nasdaq 100 index on the 26th and the Russell 2000 small cap index on the 24th. This was followed by a sharp double-digit decline. Then they all bottomed on February 9. The progress since – or a lack thereof – has been divergent.

Post-February 9 trough, the Nasdaq 100 (7083.93) was the first to rally to a new high, rising to an intraday high of 7186.09 on March 13. But it turns out the breakout was false. Soon a potentially bearish island reversal developed on the daily chart (indigo box in Chart 1). The subsequent decline stopped early April at a higher low, followed by another in the last week of April. Buying pressure was becoming evident, but the bulls were still not able to break free of congestion. Until last week.

The Nasdaq 100 remained trapped inside a rectangle for nearly a month. Also in play was an ascending triangle of the same duration. Friday, post-May jobs report, the index broke out. It is now only 1.4 percent from the March high. At least a test is the path of least resistance near term.

In May, 223,000 non-farm jobs were created. This was better than what the consensus was expecting. With this, the five-month average this year is now 207,000. If this pace sustains, 2018 would break a three-year downtrend in job creation.

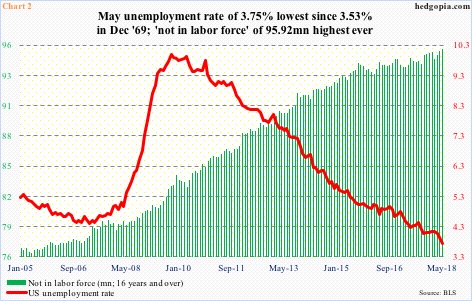

In 2017, the monthly average was 182,000, versus 195,000 in 2016, 226,000 in 2015, and 250,000 in 2014. The year-to-date pace of job creation is commendable given the US economy is less than a month away from completing nine years of recovery. It is mature. Many would say it is long in the tooth. The unemployment rate fell to 3.75 percent in May – the lowest since December 1969.

If there is a blemish in this hunky-dory story, it is that all this job growth is yet to put upward pressure on wages. Private-sector average hourly earnings rose 2.71 percent year-over-year in May. The last time this metric grew with a three handle was in April 2009. Critics can also point to the number of Americans who have opted out of the labor force. In May, there were 95.9 million of them – a new record (Chart 2). This in and of itself helps put downward pressure on the unemployment rate.

Despite all this, the jobs picture remains healthy. The collective wisdom of crowds agrees.

Small-caps, which are more domestically oriented than their large-cap peers, act the strongest.

Of the afore-mentioned indices, the Russell 2000 is the first to sustainably rally to a new high in the wake of the February low. As was the case with the Nasdaq 100, it too progressively made higher lows (Chart 3). Come mid-May, it took out the old high. In the last several sessions, the breakout has been successfully retested.

What is the message here? Is this – small-cap outperformance – a signal or a noise?

The problem right now is that large-caps are not following small-caps’ lead.

The S&P 500 has been in a box the last three weeks. As a matter of fact, Monday last week, it fell out of it, but the 50-day moving average came to the rescue. This support also approximated a falling trend line from late January which the index broke out of three weeks ago (Chart 4). In fact, it began going sideways right after that breakout.

Here is the thing.

As is the S&P 500, the Nasdaq 100 too was trapped in a box until Friday last week. Now, the road is clear for the latter to test its old high, and possibly beyond. Similarly, a rectangle breakout on the S&P 500 opens the door for a test of the upper bound of the ascending channel it is in. This lies around 2760, which is where the daily upper Bollinger band lies.

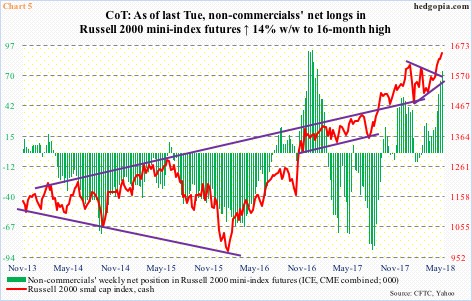

The other thing is, non-commercials fully took part in the latest small-cap rally. In the week ended March 6, they were net short Russell 2000 mini-index futures. Then they switched. As of last Tuesday, they were net long 74,239 contracts – a 16-month high (Chart 5). No such thing when it comes to the S&P 500.

Non-commercials are still net long e-mini S&P 500 futures, but have been cutting back since peaking early May. Their most recent holdings are 124,079 contracts, down 33 percent week-over-week.

In this respect, what is transpiring – or could transpire – in Nasdaq 100 index (mini) futures is worth noting. Last Tuesday, after eight weeks of staying net short, they switched to net long – a mere 6,371 contracts. But if past is prologue, this has the potential to go up (charts for both Nasdaq 100 and S&P 500 futures here). Could last Friday’s rectangle breakout set in motion this process?

Better yet, should the S&P 500 break out this week, would non-commercials begin to add to net longs? This is what the bulls are hoping for. Last Friday’s breakout on the Nasdaq 100 has bolstered their hope – the idea that small-caps seem to be pulling tech higher, and now it is large-caps’ turn.

Else, the longer large-caps lag, the easier it is to poke holes in small-caps’ leadership story. What to watch out for in this scenario? On the S&P 500, it is 2532. That is the line in the sand.

Thanks for reading!