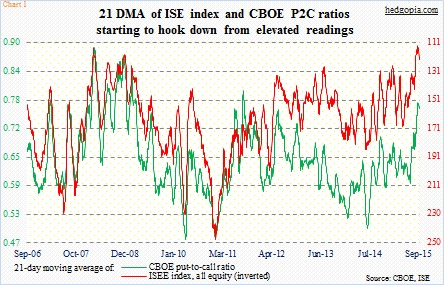

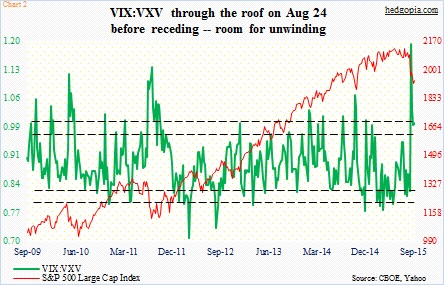

If we just focus on Charts 1 and 2 and consider how they have behaved in the past, equity bulls have reason to be optimistic. Because of the equity rout leading up to the August 24th low, both charts reached extreme readings. Historically, once a process of unwinding begins in earnest, stocks get a tailwind.

In Chart 1, a 21-day moving average has been calculated for the CBOE equity put-to-call ratio and for the ISE index (all equity) call-to-put ratio. The ISE data only goes back to 2006; on August 27, the red line made an all-time low of 112.6 (inverted in the chart). A day later, at .771 the green line recorded its highest since September 2, 2011 (was .773 back then). Both have since come under pressure – 122.9 and .762, respectively, as of yesterday. If the trend sustains, equities can do well as market participants unwind their previous bearish positions.

This is also the case with Chart 2, which simply takes a ratio of VIX, which measures one-month volatility for the S&P 500 Index, to VXV, which does the same but goes out three months. When fears are rampant near-term, VIX tends to trade at a premium to VXV. This was the case leading up to the 53.29 spike on August 24. As fears subside, VIX premium drops. Backwardation is replaced by contango. Traders begin to take on risk. Once again, if the trend sustains, equities do well.

In normal times, this would mean there is a lot of unwinding left to be done. The question is, is this one of those times, or is it different this time?

VIX has been cut in half in two weeks. Nonetheless, with two more sessions to go, it is all set to stay north of 20 for the fourth consecutive week. Fear has subsided, but it is lingering. The sell-off in equities was so quick and violent that major U.S. indices have all suffered technical damage – to varying degrees. If this is not one of those plain-vanilla sell-offs, followed by V-bottoms, the repair work is destined to be a tedious process, which the current bounce/rally likely is a part of.

Given this, support/resistance levels have taken on increasing importance. Will sellers/shorts show up near resistance, or will they get steamrolled by an avalanche of buy orders?

We got some answers yesterday.

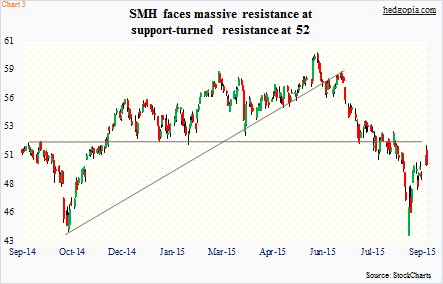

Back on August 24, in the midst of heavy sell-off, SMH, the Market Vectors Semiconductor ETF (50), was one of the sectors/sub-sectors generating early buying interest. Off that low through the intra-day high yesterday, it tacked on nearly 19 percent. That’s in 12 sessions! Chips hold an important place in the economy (along the lines of copper maybe?), and can be an important gauge of market sentiment. Yesterday, sellers showed up exactly where they were supposed to, pushing the price lower. In other words, at that point demand was simply overwhelmed by supply. Support/resistance at 52 goes back a year, and also approximates the 50-day moving average (51.31), hence worth a close watch. SMH retreated after tagging 51.75 yesterday (Chart 3), and in the process retraced 50 percent of the June 1-August 24th decline.

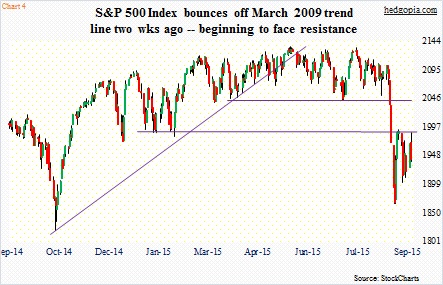

That is also the case with the S&P 500 Index (1942.04). In fact, its 50-percent retracement of the May 20-August 24 drop lies at 2001. Selling pressure is showing up much earlier. Yesterday, sellers came out of the woodwork near resistance at the 1990 level, which goes back to July last year (Chart 4). In an ideal scenario, the index would probably have a shot at 2040, where resistance is massive. That is also the area, where, once broken, the waterfall decline began. If bulls are not able to push the index up to that resistance, one can argue they are playing with a weak hand.

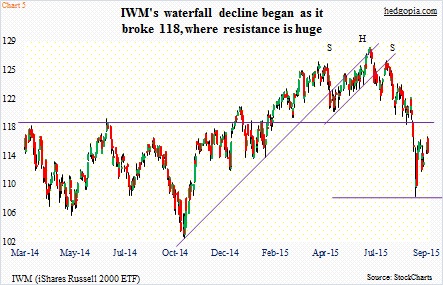

The same logic applies to IWM, the iShares Russell 2000 ETF (114.18). It has gone through a lot, acting weak since it broke the mid-October 2014 trend line in late April, tracing out a head-&-shoulders pattern and then proceeding to break the neckline (Chart 5). Ideally, it would not be uncommon for the ETF to go test that broken support at 118. It did get to 116.42 yesterday, before selling off hard. Once again, if bulls cannot regroup and test that resistance, it likely gets interpreted as a sign of weakness.

Also yesterday, QQQ, the PowerShares QQQ ETF (103.86), in the first four hours looked like it was breaking out of resistance in the 105-plus area, but the early momentum was lost, and then some, as the session progressed (Chart 6). The session high of 106.31 was only a hair breadth away from the 200-day moving average of 106.60.

After the kind of drop these indices/ETFs have suffered, it is perfectly natural to fail at resistance – on the first try in particular – but several of them are getting sold off before important levels get tested.

Translation? Bulls have more work to do, before they can take advantage of Charts 1 and 2. In the remaining charts above, the RSI is below 50 in all but one. SMH managed to push past that on Tuesday, but dropped yesterday to 50.09, and in all probability is headed lower – at least near-term. This can be a big tell. The ETF kind of led the past two weeks, and likely leads again on the way down.

Thanks for reading!