Today is one of the most anticipated FOMC meetings in a long time, if not ever.

Markets expect a hike. The Fed has convinced them of that. Fed funds futures are pricing in a 83-percent chance of a hike. The two-year Treasury – the most sensitive to monetary policy – is yielding 0.98 percent, up from 0.57 percent in the middle of October.

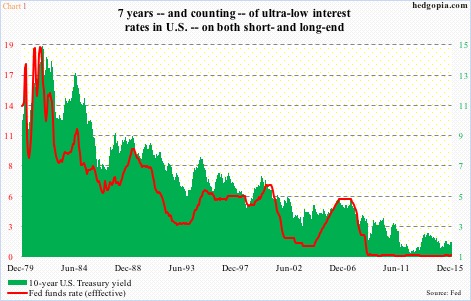

No one doubts that the Fed will make a move – its first hike in nine years (Chart 1). The trajectory of the tightening cycle is not as certain. The latter will depend on why the Fed is tightening in the first place.

There is enough reason not to raise.

Just to name a few, the ISM manufacturing index dipped below 50 in November – first sub-50 reading in three years. Capacity utilization was 77.5 percent in October, down from the cycle high 79 percent last November. Last but not the least, the equity risk premium proxy – yield spread between Moody’s Baa corporate bonds and 10-year Treasury notes – is north of 300 basis points. Going back nearly five decades, the Fed has never begun a tightening cycle with spreads that wide (more on this, here).

That said, FOMC hawks can make as good a case to at least begin a process of tightening. Rates have stayed near zero for seven years now (Chart 1). Assets are mispriced. There is no price discovery. Signs of excesses abound. All this, even as the economic recovery is maturing – now in its seventh year.

If the Fed’s aim is to get ready for the next downturn and therefore hurriedly fill its monetary quiver with arrows, then it might just be looking for a reason to draw out the tightening cycle.

This scenario will not sit well with stocks. Under this, the overbought conditions that major U.S. indices are in on a weekly basis will take over. Unwinding of these conditions likely continues. Last week’s drop in stocks will just be a prelude to what is likely to come in days/weeks to come. The S&P 500 index dropped 3.8 percent last week (Chart 2).

That said, can the Fed risk all this? The Ben Bernanke-led Fed all too often talked about the efficacy of the wealth effect. Janet Yellen’s Fed is probably no different, and likely would not want to come across as too hawkish. Stocks rally in this scenario, and might already be sniffing it.

After the sharp drop last week – Friday in particular – U.S. equities looked shaky as the week opened. Monday saw a reversal, followed by a strong Tuesday.

Bulls can point to some encouraging signs.

The S&P 500 last week lost its 50- and 200-day moving averages as well as support at 2040 and 2020. A breakout retest of 1990 – a must-hold – was just a matter of time. It was tested on Monday, and has held.

Concurrently, spot VIX, after surging 65 percent last week, opened the weak strong on Monday, only to reverse intra-day (Chart 3). The odds of a spike-reversal have grown. In this scenario, stocks get a tailwind as VIX retreats further.

At this stage, once again, it is bulls’ ball to lose. Seasonally, things tend to be in their favor. A little help from the Fed tomorrow will go a long way.

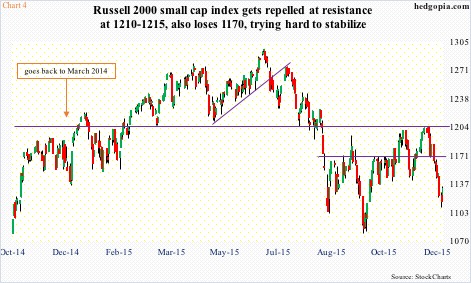

Even better if small-caps and high-yield bonds begin to attract some bids. The latter is beat-up bad, and is caught in redemption worries. And the former has been lagging its large-cap brethren for some time now (Chart 4). After it was rejected at the March 2014 resistance early this month, it has proceeded to also lose 1170 support.

How these two sectors behave in the days ahead can be treated as a telltale sign of what lies ahead for stocks.

What we don’t want to see happen is a hawkish message from the FOMC, with stocks not able to cope with the shock. Even worse would be a dovish message accompanied by a drop in stocks.

Thanks for reading!