Small-caps and tech continue to diverge. Post-vaccine news, longs are gravitating toward the former and leaving the latter. Amidst this, signs of fatigue are also showing up on the S&P 500, while VIX acts like it wants to rally.

The Russell 2000 is up 16.1 percent the last three weeks. Nine weeks ago, small-cap bulls defended horizontal support at 1450s. The rally that followed stopped just north of 1600, This level has proven to be important for both bulls and bears going back to January 2018.

Three weeks ago, during the election week, bulls cleared that roadblock. This was then followed by positive vaccine news from Pfizer (PFE), which raised investor optimism that the US economy would begin to get back to normal next year. Small-caps inherently have larger domestic exposure than their larger-cap cousins, which are also internationally exposed.

The Pfizer news lit a fire under small-caps. In the week of the 9th, the Russell 2000 finally eclipsed its old high from August 2018, but barely. Last week, in response to Moderna’s (MRNA) similarly positive vaccine news, the small cap index broke free, tagging an all-time high of 1805.20 on Wednesday but ending the week at 1785.34, leaving behind a little bit of an upper shadow, but nothing serious (Chart 1).

In the futures market, non-commercials are now sitting on most net longs in Russell 2000 mini-index futures since the last week of February this year (more on this here). Small-caps have suddenly become the go-to sector. This trade will end at some point as it becomes too lop-sided, but as things stand, there are not much distribution signs.

Tech, in contrast, is sending different vibes.

Leading up to the vaccine developments from Pfizer and Moderna, tech massively led. For the year, the Nasdaq 100 is up 36.3 percent, compared to 10.1 percent for the S&P 500 and 7.5 percent for the Russell 2000.

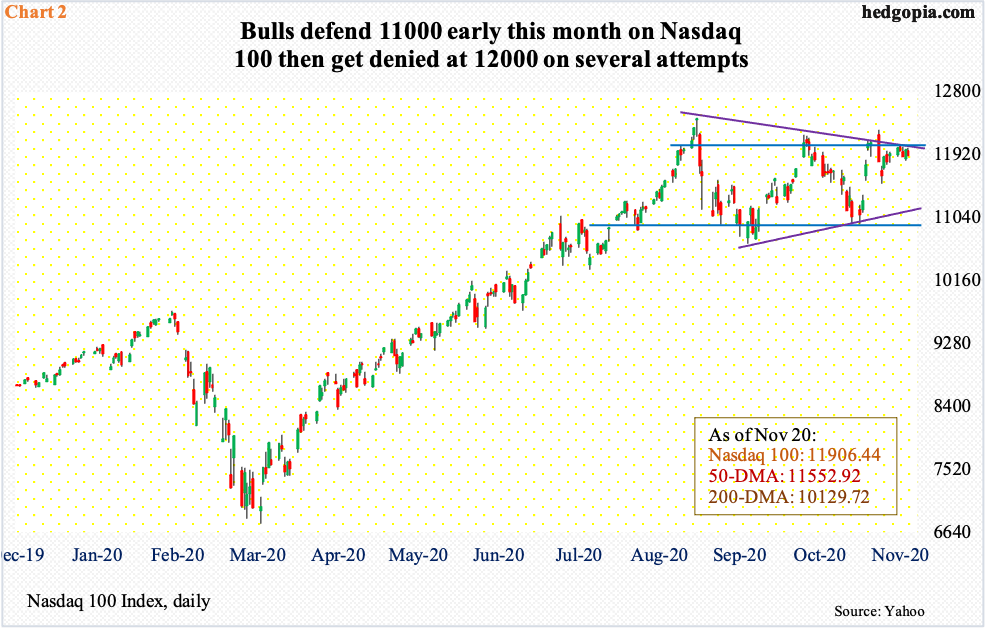

At the same time, the Nasdaq 100 has essentially gone sideways for three months now (Chart 2). Post-vaccine news from Pfizer two weeks ago, it has massively underperformed small-caps in particular, with the index down 1.5 percent, while the Russell 2000 rallied 8.3 percent.

A shift is taking place from growth to value – duration and magnitude notwithstanding. It is futile to even guess how long this trend will last. Right here and now, tech is becoming the source of money.

Last week, the Nasdaq 100 ended right on its 10-day moving average, which is flat to slightly down. Rather revealingly, on the day the Pfizer news was announced, which was 10 sessions ago, the Nasdaq 100 (11906.44) gave back its early gains to end the bearish engulfing session down 2.2 percent. In the next session, bulls defended the 50-day (11552.92) but have since struggled to build on it, facing resistance at 12000. A test of the average seems imminent. Should a breach occur, bears will be eyeing 11000, which is also where a rising trend line from September 21 lies.

The S&P 500 is not lagging the way the Nasdaq 100 is, but it, too, is showing signs of fatigue. In the week of the Pfizer news, the large cap index rallied 2.2 percent, past its old high of 3588.11 from early September. Last Monday, when the Moderna news was announced, it rallied 1.2 percent, but as the week progressed, it gave it all back and then some, losing 0.8 percent for the week.

As a matter of fact, even on the 9th when the Pfizer news was announced, the S&P 500 (3557.54) rallied to a new all-time high of 3645.99 intraday but closed the session at 3550.50, forming a shooting star; the week produced a long-legged doji.

Later last week, bulls tried to save the 10-day but failed. The average is flattish and looks ready to roll over. The daily is overbought. The next decent support is not until 3420s, which is where the 50-day (3427.28) lies.

Indices are acting this way even as optimism around vaccine development has increased tremendously. Going into the last couple of weeks, the sell-side already had very high earnings expectations.

Operating earnings estimates for S&P 500 companies bottomed way back in July – this year’s at $108.86 and next year’s at $160.89. They have since been gradually revised higher, to $120.58 and $165.86 as of last Thursday, in that order. Although the fact remains that estimates were a lot higher earlier, with 2020 at $186.36 in March last year and 2021 at $183.37 in March this year.

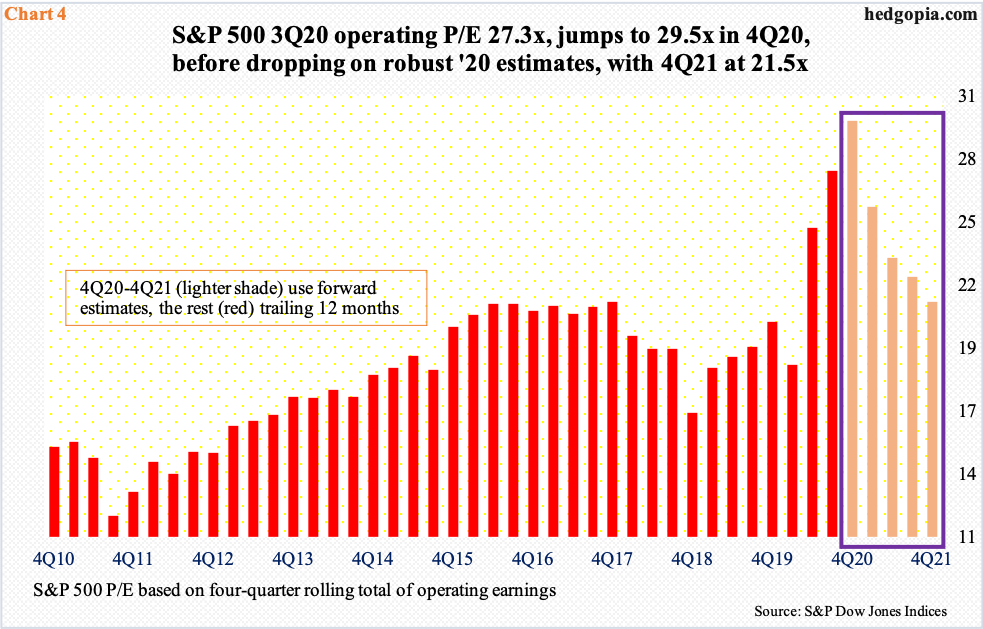

In 2019, these companies earned $157.12. The decline in earnings this year has obviously pushed up the trailing price-to-earnings ratio, which was 27.3x at 3Q20. As things stand, this jumps further to 29.5x using 4Q estimates (Chart 4). The multiple drops as next year’s numbers begin to get factored in. If 2021 estimates come through, the S&P 500 currently trades at 21.5x – not cheap by any stretch of the imagination.

There is also a risk of downward revision in the months ahead as the economy slows down in response to reduced activity owing to rising Covid-19 cases.

Oddly, the Pfizer news was unable to boost consumer sentiment.

The University of Michigan’s consumer sentiment index printed 101 in February. By April, as the economy shut down, it hit a low of 71.8. It then gradually recovered to 81.8 in October, before dropping to 77 this month.

November’s preliminary reading captures the Pfizer news, but not Moderna’s. The final number will be out this Friday.

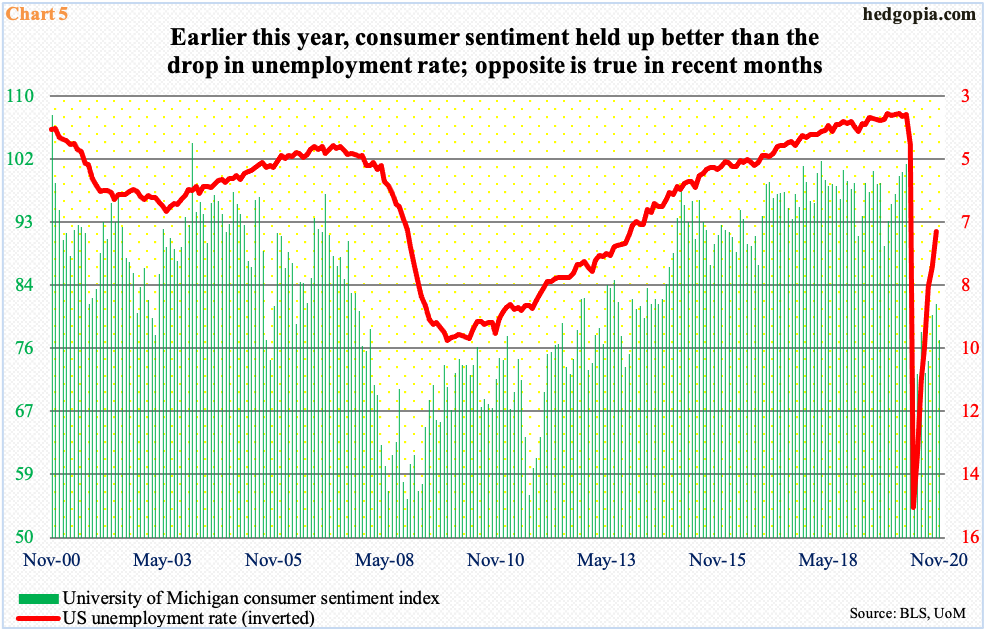

The other thing is that consumer sentiment and the unemployment rate tend to move hand in hand (Chart 5). The unemployment rate surged to 14.8 percent in April from 3.5 percent in February. Consumer sentiment, as explained earlier, dropped during the period but held up better.

In October, the unemployment rate registered 6.9 percent – quite an improvement from April’s record high. Sentiment, in contrast, is behaving in a rather subdued manner, with the positive vaccine news from Pfizer unable to give it a boost.

As explained above, except for small-caps, other major equity indices, too, are beginning to act hesitant. This, of course, followed decent rallies. A giveback is not the end of the world – rather healthy going into the last few weeks of the year.

Right here and now, VIX in this regard acts like it wants to rally. Notably, even though the S&P 500 rallied to a new high on the 9th, VIX is yet to break support at low-20s. Investors are still demanding protection.

Last Wednesday, the volatility index (23.70) dropped to 21.66 intraday, which was nearly a three-month low, but reversed higher to close at 23.84 for a hammer session. Friday produced another hammer, even as a doji showed up on the weekly. Nearest resistance lies at mid-20s, with the 50-day at 27.73.

Thanks for reading!