As the rally from the lows of October persists, there are fewer and fewer bears around. In the last several months, they have had several opportunities to gain the upper hand, but to no avail. Another opportunity is at hand. This coincides with interesting action in volatility last week.

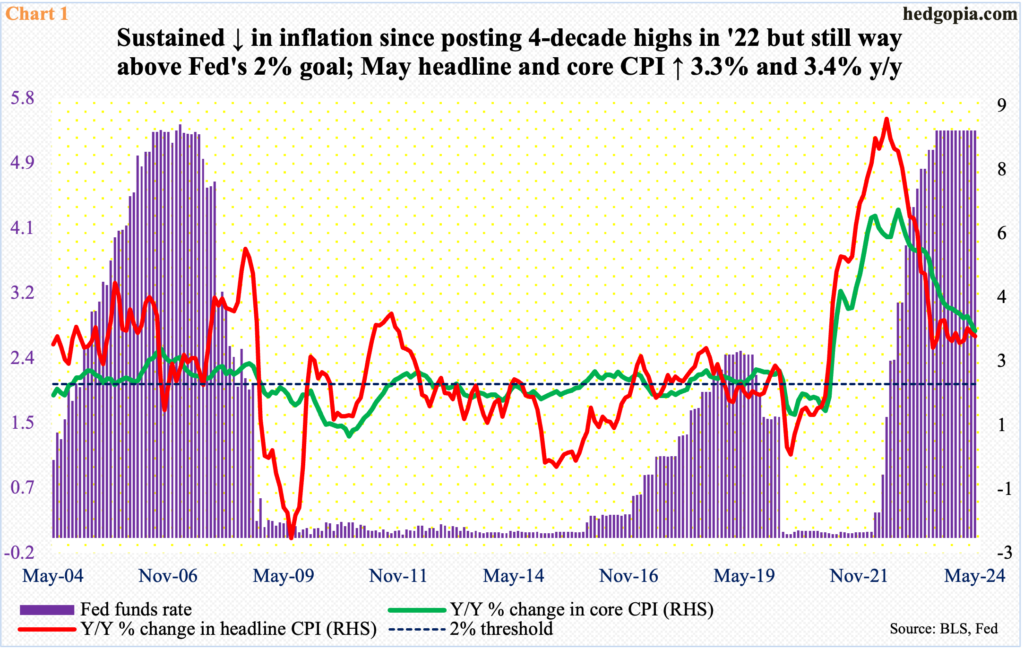

At the end of last week’s two-day FOMC meeting on Wednesday, the fed funds rate was left unchanged at a range of 525 basis points to 550 basis points. The last hike was last July, with the benchmark rates having lifted from zero to 25 basis points in March 2022.

The policy-setting body’s move last week was expected. What was probably not expected was for FOMC members to go from expecting three cuts this year during the March meeting to one; the consensus expected the dot plot to shift lower to two cuts. FOMC members’ rates outlook now is one fewer than what the futures market expects.

As much as the doves within the FOMC are itching to begin lowering rates, inflation remains comfortably above the Federal Reserve’s two-percent goal. In the 12 months to May, headline and core CPI (consumer price index) increased 3.3 percent and 3.4 percent respectively – much lower than the four-decade highs of 2022 (headline at 9.1 percent in June that year and the core at 6.6 percent in September) – but progress this year has slowed (Chart 1).

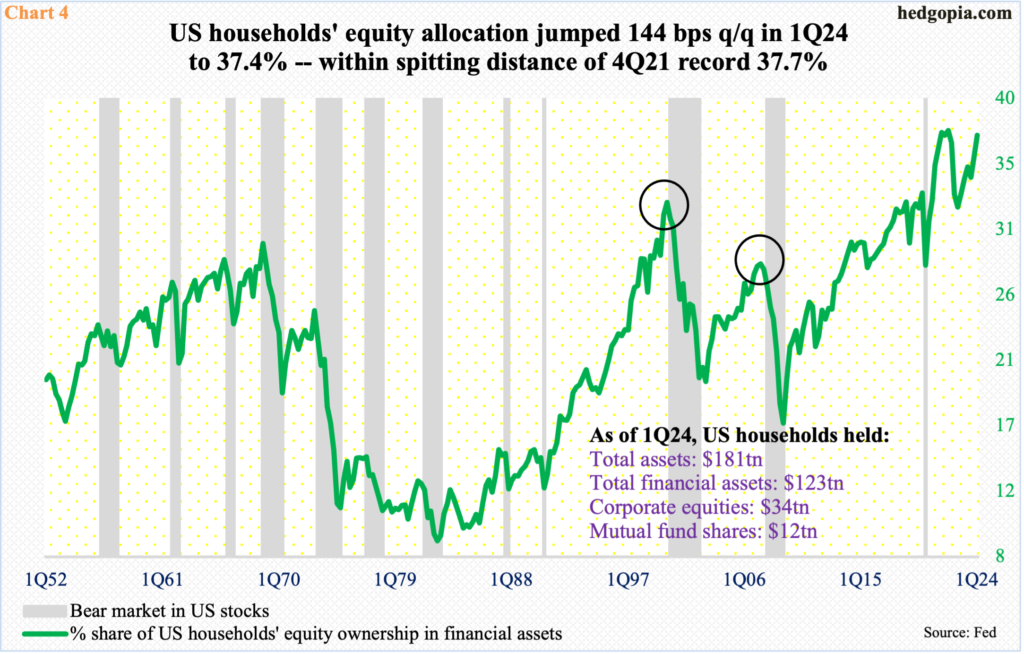

The FOMC is probably not happy with the way US equities have continued to rally, and this raises risks of upward price pressure through the wealth effect. From last October’s low through last Wednesday’s fresh intraday high of 5447, the S&P 500 is up 32.7 percent – and a mouth-watering 56 percent from the October 2022 low.

Equity bulls got aggressive last December when on the 13th Fed Chair Jerome Powell decidedly signaled a dovish shift in policy. Having just bottomed in October, the large cap index closed the 12th at 4644. Stocks were beginning to price in much lower interest rates. Post-Powell shift, futures traders early this year were pricing in six to seven 25-basis-point cuts by the end of this year.

This not surprisingly set in motion animal spirits. In more ways than one, this continues. Last week, the S&P 500 rallied 1.6 percent to 5432. This was the seventh up week in last eight. Bids persistently showed up even as it was becoming clearer that the expected cuts were not forthcoming. As things stand, two cuts are expected this year – in September and December. Stocks that rallied hard on expectation of much lower benchmark rates are not adjusting lower.

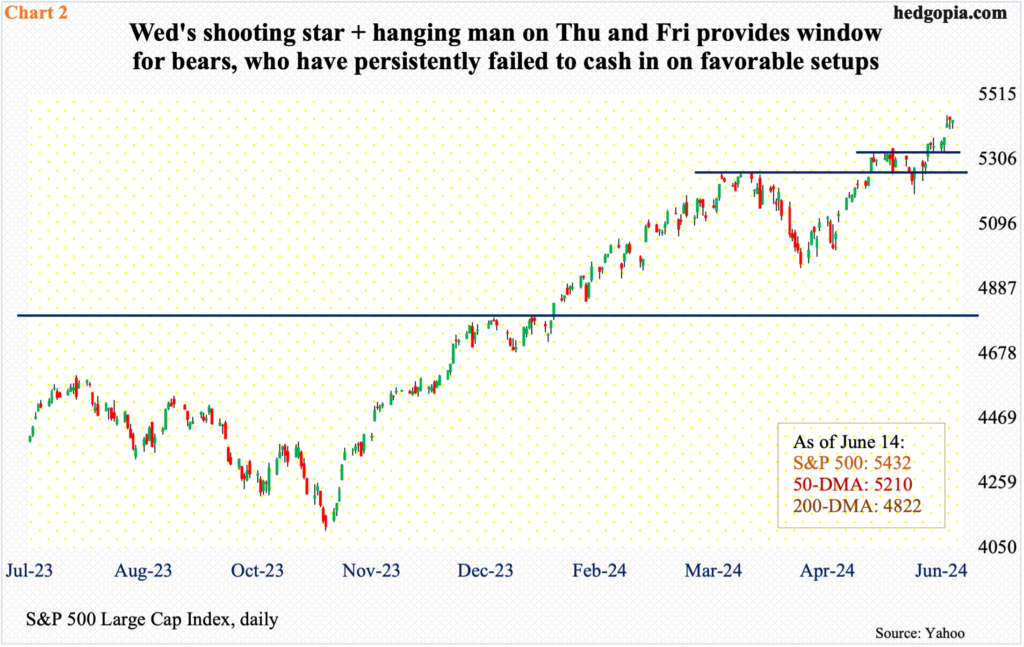

To rub salt in the wound, bears have repeatedly failed to cash in on potentially favorable technical setups. Post-October low, the S&P 500 rallied hard for four weeks before a long-legged doji – an indecision candle – showed up on the weekly. This was immediately followed by a potentially bearish hanging man, which, however, was not confirmed.

Once again, in a gap-up session in which a new high was posted, a shooting star formed last Wednesday, followed by a hanging man each on Thursday and Friday (Chart 2). This is an opportunity for the bears, but it remains to be seen if success comes their way this time.

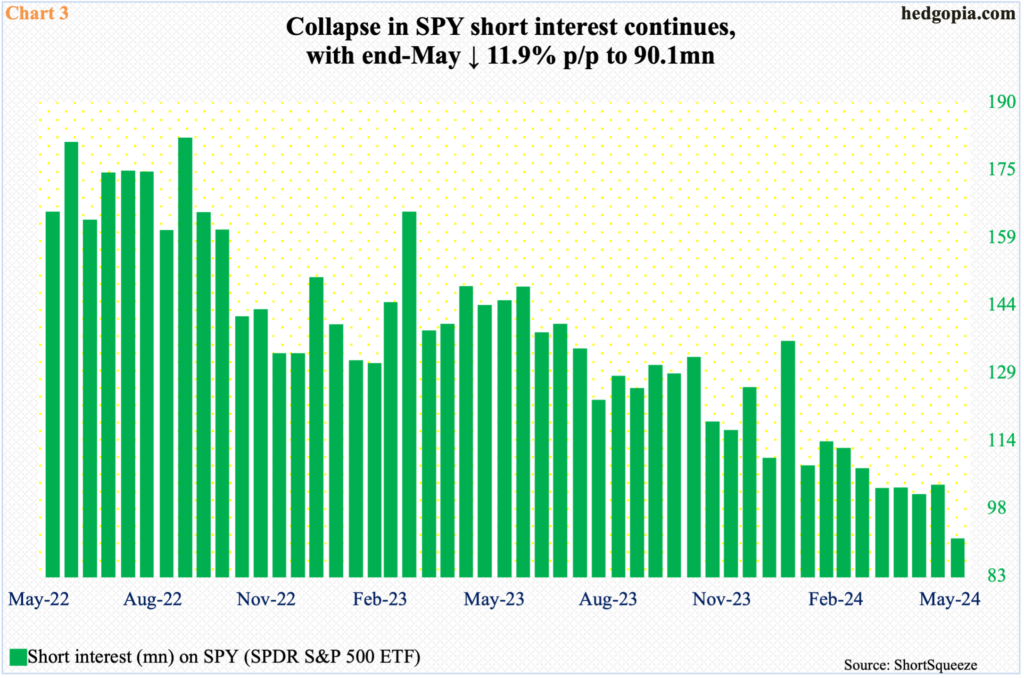

One of the things equity bulls have greatly used to their advantage is short squeeze.

As stocks were coming under severe pressure back then, by mid-September 2022, short interest on SPY (SPDR S&P 500 ETF) had ballooned to 180.5 million (Chart 3). Stocks bottomed that October, and the gradual squeeze followed. After a lot of back-and-forth, by mid-January this year, short interest once again rose to 134.7 million; it has all been downhill since then. At the end of May, short interest tumbled 11.9 percent period-over-period to 90.1 million.

In an environment in which there is a palpable lack of fear, multiple expansion continues.

After reaching an all-time high of 37.7 percent in 4Q21, US households’ equity allocation bottomed at 32.3 percent in 3Q22. From that low, the allocation has risen to 37.4 percent by the March quarter this year (Chart 4).

With nine sessions to go in the June quarter, the S&P 500 has rallied another 3.4 percent in the current quarter. Unless the index unravels in the remaining sessions, it is all but certain the 4Q21 record will be surpassed.

This nothing but adds to the bears’ woes. Bulls continue to treat both good and bad news as good, with bad news raising hopes for rate cuts. But at some point, this narrative will stop working, and the bears will gain the upper hand; as pointed out earlier, they have a decent opportunity here.

Amidst this, VIX’s behavior last week is worth a watch. In normal circumstances, VIX and the S&P 500 go in opposite directions. Last week, the two went hand in hand. VIX rallied 0.44 points to 12.66.

Going back six years, volatility bulls have repeatedly defended 12, and this seems to be happening again (Chart 5). VIX last Thursday dropped as low as 11.88 intraday but did not undercut the May 23rd low of 11.52.

If volatility bulls put their foot down, that will bring good news for equity bears.

Thanks for reading!