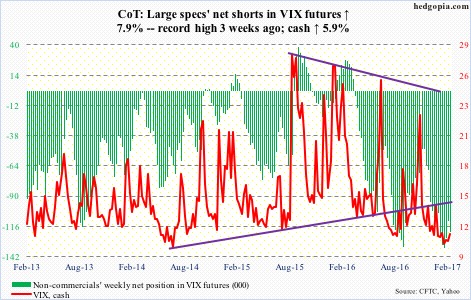

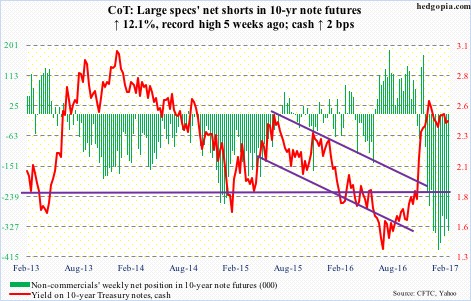

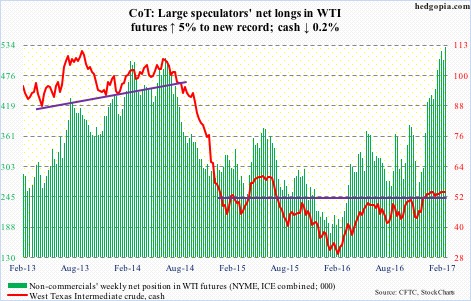

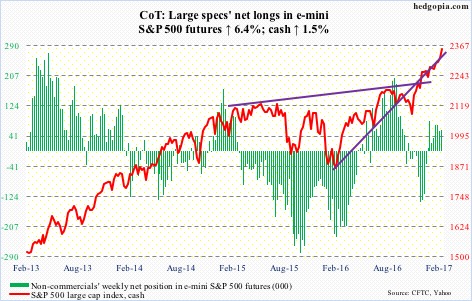

Following futures positions of non-commercials are as of February 14, 2017.

10-year note: On February 15, 10-year yields hit 2.52 percent before retreating. That high tagged a declining trend line from December 15 when yields hit 2.62 percent intraday. This pattern of lower highs makes up part of a descending triangle, the lower support of which lies at 2.3-ish.

In the face of several stronger-than-expected economic reports this week, the failure of the 10-year in mounting a rally (in yields) is revealing.

On the weekly chart, there is plenty of room for yields to continue lower. Weekly MACD just completed a bearish cross-under. Of note are non-commercials massive net shorts.

Medium- to long-term, China is the wildcard. At $1.06 trillion, it is the second largest holder of Treasury securities after Japan, which holds $1.09 trillion worth. Both have been selling, having owned $1.32 trillion (China, November 2013) and $1.24 trillion (Japan, November 2014).

China’s nonetheless is a special case. As it fights off capital outflows, it has been dipping into foreign-exchange reserves to support the yuan. Reserves dropped from $3.99 trillion in June 2014 to $2.998 trillion in January. Hence the need to sell Treasurys.

Currently net short 341.5k, up 36.9k.

30-year bond: Major economic releases next week are as follows. Monday is Presidents Day.

Wednesday brings existing home sales (January) and FOMC minutes for the January 31-February 1 meeting.

Existing home sales in December fell 2.8 percent month-over-month to a seasonally adjusted annual rate of 5.49 million units. November’s 5.65 million was the highest since 5.79 million in February 2007.

New home sales (January) and the University of Michigan’s consumer sentiment index (February, final) come out on Friday.

New home sales fell 10.4 percent m/m to 536,000 units (SAAR) in December. Sales peaked last July at 626,000 units – the highest since 627,000 in January 2008.

Preliminarily, consumer sentiment dropped 2.8 points m/m in February. January’s 13-year high 98.5 was 11.3 points higher than last October – that is post-election.

Currently net short 26.2k, down 10.7k.

Crude oil: Yet another sizable buildup in U.S. crude stockpiles!

For the week of February 10, crude stocks surged 9.5 million barrels to 518.1 million barrels. This followed increase of 13.8 million barrels in the prior week. Inventory is the highest ever (data goes back to August 1982).

Gasoline stocks rose, too, by 2.8 million barrels to 259.1 million barrels – also a record (data goes back to January 1990).

Despite this massive buildup in both crude and gasoline, spot West Texas Intermediate crude hung in there on Wednesday, down 0.2 percent, with the session low bouncing off of the 50-day moving average, which is now going flat.

Refinery utilization dropped 2.3 percentage points to 85.4 percent – a 15-week low.

On the positive – if it can be labeled that – crude production inched lower, by 1,000 barrels per day to nine million b/d. Prior week was a 44-week high… Crude imports fell by 881,000 barrels per day to 8.5 mb/d. Prior week was the highest since September 2012… Distillate stocks shrank 689,000 barrels to 170.1 million barrels. Prior week was the highest since October 2010. Evidently, despite the latest drop, all these three remain elevated.

This should continue to be a roadblock to oil bulls’ attempt to break the crude out of the recent range – $54-plus on the up and $52-plus on the down. Particularly considering non-commercials are the most bullish ever even as crude inventory is at a record high!

After doubling in price from the February lows last year, spot WTI has gone sideways for 11 weeks. Odds favor the sideways action gets resolved by losing the afore-mentioned support.

Currently net long 530.4k, up 25.1k.

E-mini S&P 500: In the first three sessions this week, the cash rallied 1.4 percent. The move was nicely aided by inflows. SPY, the SPDR S&P 500 ETF, attracted $4.6 billion in those three sessions. In the week through Wednesday, the ETF took in $3.2 billion, which followed a loss of $3 billion in the prior week (courtesy of ETF.com).

In the same week, U.S.-based equity funds attracted $11.5 billion. This is in addition to $16.2 billion in the prior two (courtesy of Lipper). Importantly, post-November 8 U.S. presidential election, these funds took in $42.1 billion, and SPY $18.3 billion.

Behind the nearly 10 percent rally in the cash since the election, it is not just short squeeze. Flows are cooperating as well. Investor/trader expectations have gone up big time. This week, Investors Intelligence bulls continued to remain north of 60 percent (61.8 percent) – with five of the last seven in the 60’s and north of 50 in the last 13 weeks!

The balance is tilted way too much to the optimistic side. That said, momentum is intact. In times like these, it always helps to be on the lookout for reversal signs.

Currently net long 57.8k, up 3.5k.

Euro: The cash is dancing to the music of technicals.

On February 2, the euro filled the gap of November 14 last year, rising to 108.29. Then it dropped. Guess where it stopped? At 105-plus. This support goes back nearly two years. During all this, the 50-day moving average was lost and then recaptured. Friday, the currency literally closed on that average – a must-save.

On the daily chart, euro bulls have an opportunity to carve out the right side of a potential inverse head-and-shoulders pattern, the neckline of which will be broken around 108. Daily conditions are oversold.

Currently net short 46.8k, up 1.8k.

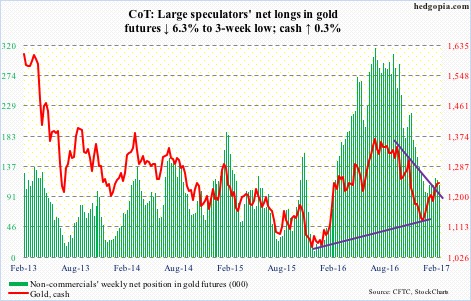

Gold: Gold bugs are defending support. Wednesday and Thursday, they showed up near the 20- and 10-day moving averages, respectively. Both are rising. As is the 50-day. They are probably shooting for the 200-day ($1265.19). Before that, the cash needs to take out $1,246-plus where it met with resistance last week. This was a price level off of which the metal rallied in October last year.

Thus far, flows are cooperating. In the week ended Wednesday, GLD, the SPDR gold ETF, attracted $434 million. In the past three, it took in $1.8 billion (courtesy of ETF.com).

Currently net long 109.8k, down 7.4k.

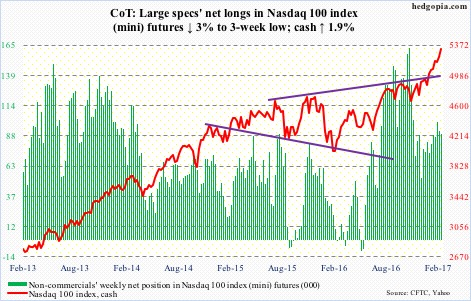

Nasdaq 100 index (mini): The cash enjoyed its seventh consecutive weekly rallies. The last time the index rallied for such a long stretch was in June-August last year. Back then, the stretch ended there, before dropping three-plus percent in the next five.

As relentless as the current rally has been, momentum is yet to crack, with shorter-term moving averages sharply rising – nearly parabolic.

Both this week and last week, the Nasdaq 100 rallied in the face of outflows from QQQ, the PowerShares Nasdaq 100 ETF. In the week ended Wednesday, $527.1 million left, following redemptions of $819.1 million in the prior week (courtesy of ETF.com).

For whatever it is worth, a long-legged doji showed up on Apple (AAPL) on Wednesday. Remains to be seen if the bears can make something out of it.

Currently net long 89.7k, down 2.7k.

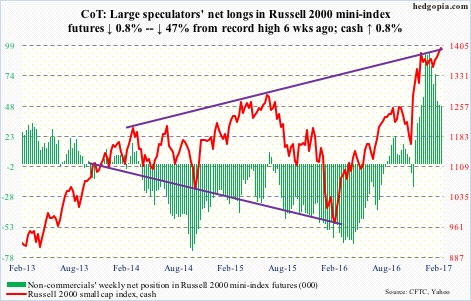

Russell 2000 mini-index: Finally, a breakout, albeit a meek one. And a new high (1405.21). After going sideways in a rectangle/flag formation for nine weeks, the cash broke out Tuesday, followed by breakout retest on Wednesday through Friday. Ideally, technicians would be eyeing a measured-move target of 1440-ish.

However, considering how extended the Russell 2000 is, the best the small-cap bulls can hope for near term is a retrenchment and then a successful retest of 1347 support, before rallying again.

Flows continue to be off and on, and that needs to change. In the week ended Wednesday, $280 million moved into IWM, the iShares Russell 2000 ETF, following outflows of 1.1 billion in the prior week (courtesy of ETF.com).

Currently net long 48.7k, down 380.

US Dollar Index: Wednesday, the cash tried to retake the 50-day moving average, but was rejected. The slight weakness since preceded 10 straight up sessions.

The dollar index could very well be forming the right shoulder of a head-and-shoulders formation, which, if completes, would be bearish. Support at 99-plus is a must-save. The neckline lies a little above that.

Currently net long 45.9k, down 872.

VIX: It is not often both the S&P 500 and VIX rally together. Yet that is what happened this week, with VIX up 5.9 percent and the S&P 500 up 1.5 percent.

With stocks rallying right from the word go, the week started out normal as far as volatility went; VIX was rejected at 10- and 20-day moving averages. Things changed on Wednesday, when it shot up 11.5 percent – past its 50-day; the S&P 500 rallied 0.5 percent in that session! There were all kinds of theories making the rounds for this odd behavior, including one that blamed a failing hedge fund for this.

Whatever the reason, that protection-buying did not sustain. By Friday, VIX was back below 50-day.

This oddity was also reflected in the VIX-to-VXV ratio, as it pushed higher to .84. Apparently, VIX (30-day volatility) rallied more than VXV (three months). Leading up to this, the ratio lingered in the .70s for six straight weeks – and in 10 out of 12.

One more example of the current giddy sentiment: the CBOE put-to-call ratio in the .50s the past four sessions.