The following are futures positions of non-commercials as of August 25, 2015. Change is week-over-week. (Please keep in mind that these holdings are as of Tuesday. By then, from high to low the S&P 500 was down 12.5 percent. In the next three sessions, it rallied 6.5 percent to end the week up 0.9 percent. So holdings may have changed substantially.)

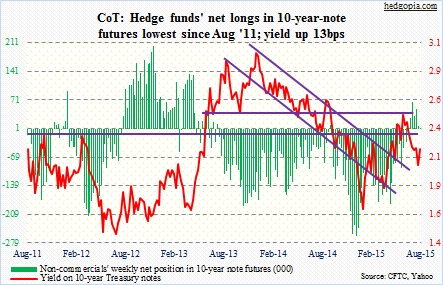

10-year note: Talk about dichotomy.

Here we have China where the authorities are giving off bad vibes. They have intervened in the stock markets, simultaneously cut interest rates (by 25 basis points) and banks’ required reserve ratio (by 50 basis points), devalued the yuan, expanded local government debt swap quota by RMB1.2 trillion to a total of RMB3.2 trillion, among others. If Citi is right, they have a reason to act panicky. The bank thinks the nation is growing at 4.5 percent or less, and is sliding into a recession. Evercore ISI says the Chinese economy shrank in July.

And then we have the U.S., where things are not booming but hanging in there. In fact this week, 2Q15 real GDP was revised up to 3.7 percent (from previous 2.3 percent), although inventory accumulation played a big role in this. Plus, gross domestic income only grew 0.6 percent during the quarter; GDP measures production, and GDI the income generated from production. In theory, the two should be identical. TLT, the iShares 20+ Year Treasury ETF, was not bothered by the 3.7-percent print (was essentially unchanged on Thursday). With that said, growth did snap back from the dismal 0.6 percent in 1Q.

Good enough for the Fed to hike? The week saw various FOMC members voice their opinion – some for, some against. Here is the rub. The U.S. and China are the world’s two largest economies. In an increasingly connected world, if the latter sneezes, would the former not catch a cold?

In the meantime, non-commercials cut net longs to the lowest since August 2011 – quite a U-turn; they were net long nearly 66,000 contracts just a month ago. They are not in agreement with TLT longs.

Currently net long 1.3k, down 6k.

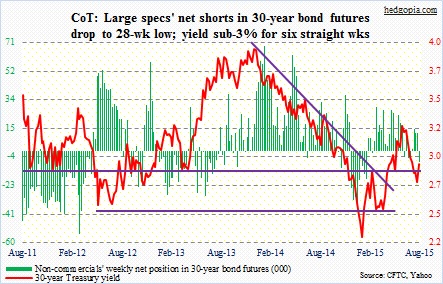

30-year bond: Here are the major economic releases next week.

August’s ISM manufacturing index comes out on Monday. Non-manufacturing is on Thursday. The former continues to post weaker readings versus the latter. In July, they were 52.7 and 60.3, respectively. It is the same with new orders – 56.5 and 63.8, respectively.

On Wednesday, we get the revised productivity numbers for the second quarter. The preliminary reading showed non-farm output per hour grew a mere 0.3 percent annually. Recent productivity trends have been very disappointing – to say the least. The last time it grew with a two handle was in 3Q10.

The advance report on July’s durable goods was published this week. More detailed estimates, as well as non-durable goods, are on tap on Wednesday. During the month, orders for non-defense capital goods ex-aircraft rose 2.2 percent month-over-month, and June was revised higher; as well, inventory fell a tad, with downward revision in June. With that said, July orders were still 5.4 percent off the September 2014 high of $74 billion; year-over-year, orders have fallen for six straight months.

Friday, we get August’s employment report. With the FOMC scheduled to meet on September 16-17, needless to say, this is an important release. Jobs momentum has downshifted this year, with the January-July average of 211,000. Wage growth is still a no-show. For what it is worth, core PCE inflation in July rose at an annual rate of 1.2 percent – the lowest since March 2011. The Fed is in a tight spot.

Three FOMC members are scheduled to speak next week.

Currently net short 7.2k, down 19k.

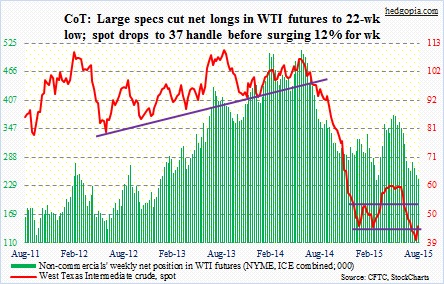

Crude oil: U.S. stocks fell 5.5 million barrels in the August 21st week, to 450.8 million barrels. But stocks of crude oil and refined products rose to a record 1.283 billion barrels. Spot West Texas Intermediate crude reacted to the latter on Wednesday. Thursday was different. Oil caught a bid, with spot WTI rising 10 percent and another 5.9 percent on Friday.

WTI was grossly oversold – down nearly 39 percent in the couple of months until it rallied on Thursday. Fall demand will be the weakest of the year, with scheduled refinery maintenance. So being able to rally here should hearten the oil bulls. Schlumberger’s (SLB) plan to buy Cameron International (CAM) probably helped sentiment. Hard to say if this is a sign of large companies seeing value or the weak ones forced to sell assets as oil has stayed low for too long.

For now, oil needs the benefit of the doubt. In the end, this could very well be a technical bounce. But price action has improved. For the week, WTI has produced a high-volume, bullish engulfing candle. It has a shot at $49-$50; there is massive resistance at $54.

Currently net long 241.9k, down 8.2k.

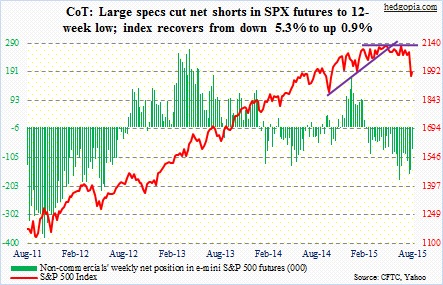

E-mini S&P 500: In the week ended August 26, U.S.-based stock funds lost $17.8 billion – the biggest outflows since mid-December last year. Of this, $11.7 billion came out of funds specializing in U.S. shares, and $6.1 billion out of non-U.S. shares. Breaking it down further, ETF outflows were $15.2 billion, while $2.6 billion was withdrawn from stock mutual funds (courtesy of Lipper).

Speaking of ETFs, in the minutes after the opening bell on Monday dozens of stock ETFs failed to accomplish what they were supposed to do – trade in line with the indices they are designed to track! S&P 500-tracking ETFs were down as much as 26 percent even as the index was down five percent. GE was down 21 percent at one point. Nimble shorts probably made a killing. But then again, they probably got killed on Wednesday and Thursday, when the S&P 500 jumped 6.5 percent. It is hard to tell if the two-day surge was fueled by elevated short interest or by genuine buying interest.

V-bottoms are rare after the kind of technical damage indices have suffered. Support levels have been breached left and right. The S&P 500 now has a daily death cross. Moves have been fast and furious. With that said, during the sell-off several indicators got pushed to extremes, so have room for unwinding. The first line of resistance is right here – 1990ish – with the next one at 2040.

Ideally, it would be healthy if the S&P 500 goes lower and successfully tests the lows of this week.

Currently net short 75.7k, down 70.8k.

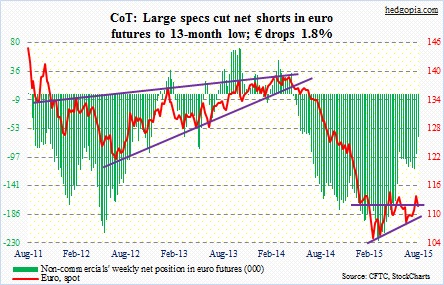

Euro: On Wednesday, Peter Praet, ECB chief economist, said the bank is ready to expand its bond-buying program if needed as “recent developments in the world economy and in commodity markets have increased the downside risk of achieving the sustainable inflation path toward two percent.” The euro shed 1.7 percent that day, and another 1.2 percent in the next two. Germany, Europe’s exports powerhouse, in particular must be grinning.

Since March this year, the ECB has been buying €60 billion a month worth of bonds, and apparently seems ready to do more if the need be. The central bank put is alive and well. Here at home, Bill Dudley, the New York Fed president, just a few hours after Mr. Praet’s comments, hinted that a September hike may not happen after all. Coincidence or not, U.S. stocks bottomed. Later, speaking to CNBC at Jackson Hole, Stanley Fischer, Fed vice chairman, said September liftoff was undecided amid market volatility.

Be that as it may, the euro seems to want to go lower – probably wants to go test the 50-day moving average (110.9).

Currently net short 66.1k, down 26.7k.

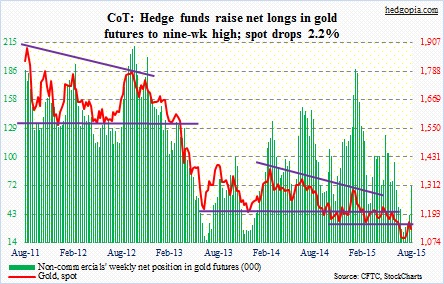

Gold: Yes, the metal was overbought near-term, but its inability to rally on Monday and Tuesday must be disheartening as far as gold bugs are concerned. For the week, gold shed 2.4 percent. It probably followed the dollar, which rose nearly 1.2 percent. The 1,180 resistance proved too strong to conquer. The metal is literally sitting on the 50-day moving average.

Importantly, non-commercials continue to add to net longs, which have gone up by 46,000-plus in the past month.

Currently net long 70.7k, up 29.1k.

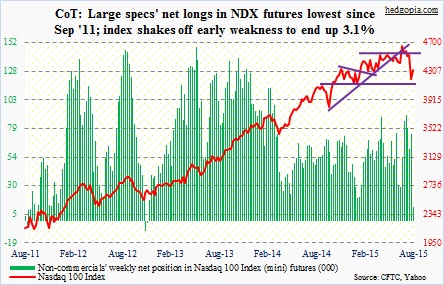

Nasdaq 100 index (mini): During the week, the index traveled 553 points! At its worst, it was down nearly 10 percent, but ended the week up 3.1 percent! In the process, the weekly chart has produced a high-volume solid white candle. The index is right underneath resistance currently. The 200-day moving average is only 54 points away.

Non-commercials continue to lean cautious, however, having cut back net longs to a nearly four-year low. For whatever it is worth, Apple (AAPL) just suffered a death cross.

Currently net long 11.4k, down 62.4k.

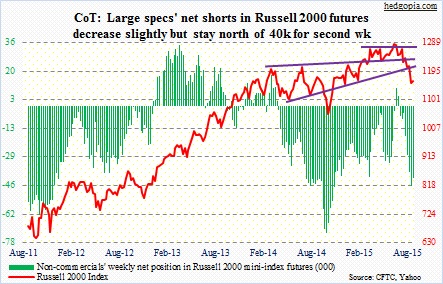

Russell 2000 mini-index: During the first three sessions this week, the ratio of RVX, the Russell 2000 Volatility Index, to VIX, the S&P 500 Volatility Index, went below parity. RVX only goes back nine years, but in the past the ratio has shown a tendency to trade near/under parity near bottoms. Will it work this time?

Non-commercials maintained their north of 40,000 net short exposure for the second week running.

Currently net short 41.4k, down 4.7k.

US Dollar Index: On Monday, when there was a bloodbath in equities, the dollar failed to act as a safe haven. At one point that day, the index was down 2.6 percent – a huge daily move for any currency. Maybe because it lost its 200-day moving average, then becoming a self-fulfilling prophecy. The remaining four sessions, it rallied, and is now back above that average.

Non-commercials continue to lose faith. Since peaking at just north of 81,000 early March this year, net longs are down 36 percent.

Currently net long 52.2k, down 10.7k.

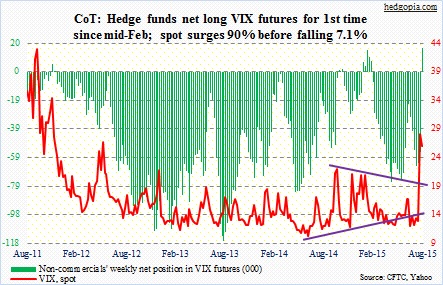

VIX: In a quiet market when futures are in contango, selling downside puts makes sense. It is a popular way to earn premium. In an environment in which VIX spikes, these puts begin to attract bids, as traders begin to price in a VIX reversal. This unfolded particularly on Thursday as front-month puts were being gobbled up left and right. So far the strategy has paid off.

As spot VIX was spiking, VIX futures never believed the spike was permanent.

The thing to watch going forward is if VIX manages to stay above 20 next week, and maybe the week after. That will be worrisome. It has been over 20 for two straight weeks, and trending higher. The ideal scenario for equities is if the air continues to come out.

Non-commercials are betting on an elevated VIX scenario. They went net long – for the first time since mid-February.

Currently net long 16.8k, up 71.7k.

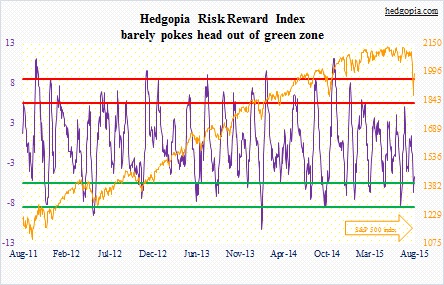

Hedgopia Risk Reward Index