Following futures positions of non-commercials are as of May 14, 2019.

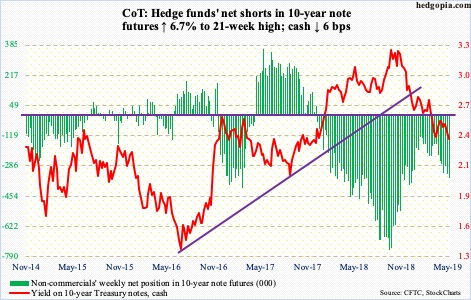

10-year note: Currently net short 352.8k, up 22.3k.

Last October, the 10-year Treasury yield (2.39 percent) peaked at 3.25 percent before coming under sustained pressure. It bottomed at 2.36 percent in March. The rally since that low stopped at 2.62 percent, a crucial level going back a decade. The March low was tested this Wednesday – successfully. The daily is oversold, so at this point in time the risk is more to the upside than to the downside.

With that said, major moving averages are all pointing down. If yields rally near term, the 50-day, which lies at 2.51 percent, can entice bond bulls. They likely will be salivating if 2.62 percent is tested. The latter is not going to give way anytime soon. Bond bears, including non-commercials with sizable net shorts in 10-year note futures, may have to wait a while before that happens.

30-year bond: Currently net short 45.9k, up 10.9k.

Major economic releases next week are as follows.

Existing home sales for April are due out Tuesday. March sales were down 4.9 percent month-over-month to a seasonally adjusted annual rate of 5.21 million units. The cycle high 5.72 million units was reached in November 2017.

On Wednesday, FOMC minutes for the March 19-20 meeting are released.

Friday has April’s durable goods on tap. In the 12 months to March, orders for non-defense capital goods ex-aircraft – proxy for business capex plans – increased 5.3 percent to $70 billion (SAAR), a new high.

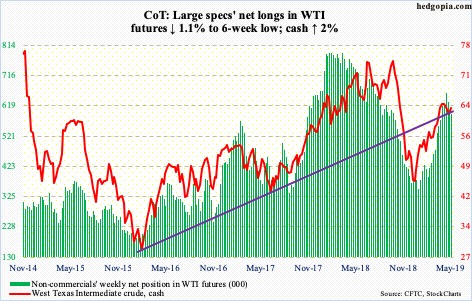

Crude oil: Currently net long 593.1k, down 6.8k.

Oversold technical conditions plus Middle East tensions helped the cash ($62.92/barrel) rally two percent this week.

For two weeks prior to Thursday’s 1.4-percent rally, the crude essentially went sideways, with bulls hugging the converging 50- and 200-day moving averages. A golden cross formed last week, with merely $1.10 separating the two. Four weeks ago, WTI peaked at $66.60. For continued momentum, bulls need to take out short-term resistance just north of $63 and then $64.70s, before that high could be tested.

Bulls Wednesday shrugged off the 5.4-million-barrel buildup in US crude stockpiles. At 472 million barrels, the current level is the highest since September 2017. The EIA report for the week of May 10 also showed distillates rose 84,000 barrels to 125.6 million barrels. As did crude imports, which increased 919,000 barrels per day to 7.6 million bpd – an 18-week high. Gasoline stocks, however, fell 1.1 million barrels to 225 million barrels – a 24-week low. Crude production dropped 100,000 bpd to 12.1 mbpd. And refinery utilization rose 1.6 percentage points to 90.5 percent.

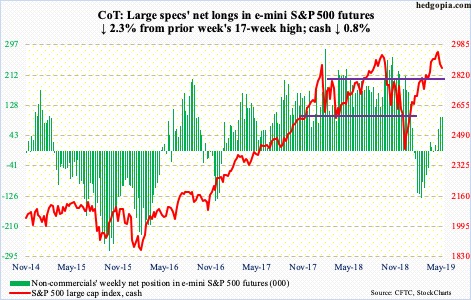

E-mini S&P 500: Currently net long 93.9k, down 2.2k.

Another $12.3 billion left US-based equity funds (courtesy of Lipper). In the same week, SPY (SPDR S&P 500 ETF), VOO (Vanguard S&P 500 ETF) and IVV (iShares core S&P 500 ETF) lost a combined $6 billion (courtesy of ETF.com), even as money-market funds rose $16.6 billion to $3.1 trillion (courtesy of ICI).

The week offered a little something for both bulls and bears. The cash (2859.53) opened with a 2.8-percent intraday drop Monday but found support at just north of 2800. For 14 months now, this price point has provided support and resistance. The most recent breakout took place mid-March. This week’s action was a successful retest. However, before bulls could think of testing the all-time high of 2954.13 from May 1, they would first need to reclaim 2890s, which bears defended both Thursday and Friday. The weekly has plenty of room to continue unwinding its overbought condition. Traders have not really taken to risk-on.

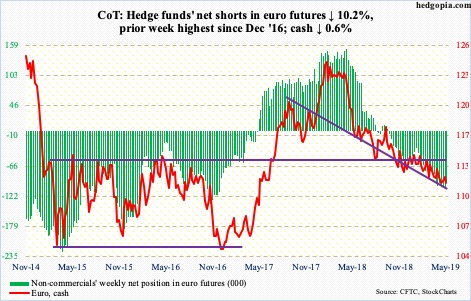

Euro: Currently net short 95.3k, down 10.8k.

Once again, the cash ($111.64) was rejected at the still-declining 50-day. Monday’s intraday high of $112.63 came close – but not quite – to breaking a pattern of lower highs in place since the euro peaked at $125.37 in January last year. Amidst this, bulls can take solace in the fact that since the late-April low of $111.12, higher lows have formed. Currently, the daily is in the process of unwinding its overbought condition. Friday produced a spinning top. Should that low be tested, bulls likely will step up – for now.

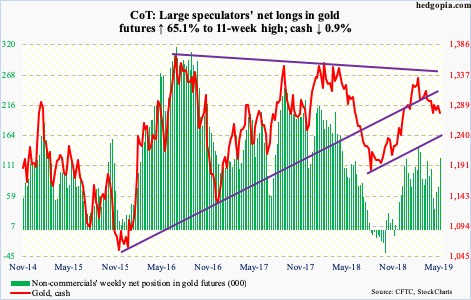

Gold: Currently net long 124.5k, up 49.1k.

Non-commercials did their bit, with net longs at an 11-week high. Their holdings are as of Tuesday, when the cash ($1,275.70) rallied to $1,304.20 intraday. Resistance just north of $1,300 goes back a while. By then, the daily was pushed well into overbought territory. In the meantime, gold-focused ETFs continued to bleed. In the week to Wednesday, GLD (SPDR gold ETF) and IAU (iShares gold trust) respectively lost $268 million and $190 million (courtesy of ETF.com). In the prior four, they collectively lost $1.3 billion.

As a result, gold bugs were unable to recapture $1,300. The metal currently is in the process of unwinding its daily overbought condition. Support at $1,280s is slightly breached. The next one lies at $1,260s, which also approximates the daily lower Bollinger band and has been defended twice in the past month.

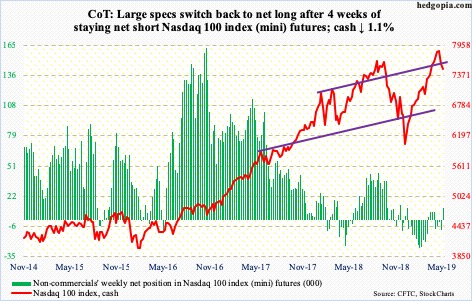

Nasdaq 100 index (mini): Currently net long 11.5k, up 20.8k.

The cash (7503.68) opened the week with a loss of the 50-day, dropping to 7303.64 intraday Monday. At least until Wednesday, flows were not in cooperation, as QQQ (Invesco QQQ trust) lost $187 million in the week ended that session (courtesy of ETF.com).

Despite this, from down 3.7 percent intraday Monday to down 1.1 percent for the week, bulls did salvage the damage. They would love to go and test 7700 again, but this is proving tough right at this minute. Weekly momentum indicators continue lower. After an extended run – up in 18 out of 19 weeks – this was the second consecutive down week.

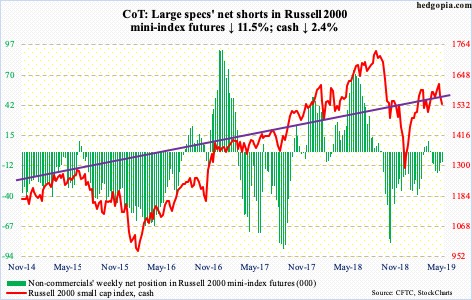

Russell 2000 mini-index: Currently net short 8.4k, down 1.1k.

Several times going back to January last year, bulls and bears locked horns just north of 1600. The rally from last December stopped on February 25 at 1602.10. Later, on April 29, it again retreated from 1603.08. So, on the 6th this month when the cash (1535.76) closed at 1614.98, hopes were high that a breakout would result in a jump in risk-on sentiment. Things did not quite pan out that way.

Monday, the Russell 2000 sliced right through the 50- and 200-day, which have converged. The index already lost a trend line from last December. As things stand, even if the daily continues to unwind its oversold condition, a test of that resistance is looking difficult.

In the week through Wednesday, IJR (iShares core S&P small-cap ETF) gained $85 million, but IWM (iShares Russell 2000 ETF) lost $364 million. For the latter, this was the fifth straight week of outflows, having lost $1.5 billion in the prior four (courtesy of ETF.com).

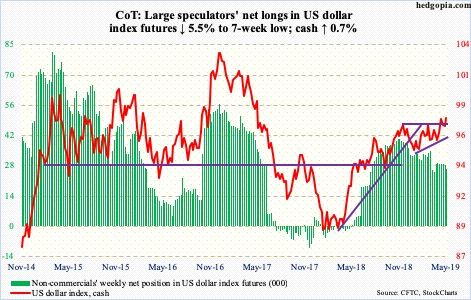

US Dollar Index: Currently net long 26.7k, down 1.6k.

After defending the 50-day on Monday, dollar bulls once again hammered on – and succeeded in clearing – resistance at 97.50s. This level repelled breakout attempts for six months now. Last September, the US dollar index (97.82) dropped to 93.39 before making higher lows. The resulting ascending triangle can be a continuation pattern. For now, the daily has room to continue higher. Three weeks ago, the index retreated after posting 98.09, which has now gained in significance.

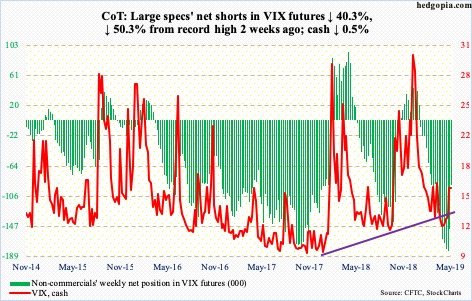

VIX: Currently net short 89.7k, down 60.6k.

After last week’s spike reversal, premium came out fast this week. The cash (15.96) tried to rally Monday but could not keep up the momentum. By Wednesday, the 200-day was lost. The 50-day rests at 14.37. For a couple of months now, volatility bulls have consistently defended 12, a test of which is their worse-case scenario near term. This probably does not come to pass near term.

Non-commercials have begun unwinding their record net shorts in VIX futures. In a couple of weeks, holdings have been cut in half. Unwinding can continue. In the meantime, the cash just formed a potentially bullish weekly MACD crossover.

Thanks for reading!