Following futures positions of non-commercials are as of January 28, 2020.

10-year note: Currently net short 270.5k, down 32.1k.

The Fed has a dual mandate of maximum employment and stable prices. The post-Great Recession recovery/expansion has been uneven, but jobs have been plentiful. Through last December, the cycle, which is five months short of completing 11 years, created 21.4 million non-farm jobs. But inflation remains subdued. This gives the central bank an opportunity to focus on either jobs or inflation, depending on if it wants to lean hawkish or dovish.

This week’s FOMC meeting was a non-event, in that no action was expected, and none came, but the inflation language was tweaked a little. During Wednesday’s post-statement Q&A, Chairman Jerome Powell said that the goal of that tweak was to “send a clearer signal that we are not comfortable with inflation running persistently below our two percent symmetric objective.” It increasingly feels like the Fed is laying the groundwork for more stimulus.

Last year, the fed funds rate was cut by 75 basis points in three 25-basis-point increments, to a range of 150 to 175 basis points. Ahead of this week’s meeting, fed funds futures were forecasting a 25-basis-point cut in November/December with odds in the 50 percent. By Friday, markets readjusted in a big way, assigning 50/50 odds of a cut by the April meeting and another one by December. Should it come to pass, the policy rate will have dropped to 100-125 basis points. A few more cuts, and the Fed will have no option than to expand its balance sheet. In fact, this is already happening.

SOMA (System Open Market Account) holdings increased from $3.55 trillion late September to $3.77 trillion this week. These assets, after having peaked at $4.24 trillion in April 2017, up from under $500 billion pre-2008/2009 financial crisis, were getting trimmed, but are rising again. Reading the Fed’s tea leaves, the balance sheet is headed a lot higher in quarters/years to come. This is bound to reverberate through a whole host of assets, not the least of which is the bond market.

For the week, the 10-year Treasury yield (1.52 percent) lost 16 basis points.

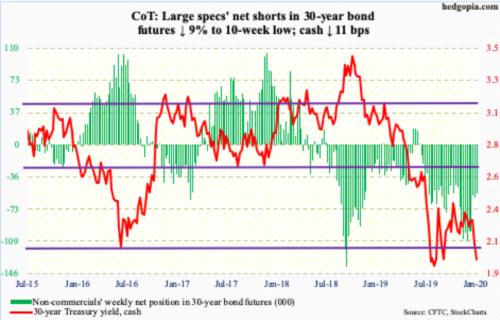

30-year bond: Currently net short 55k, down 5.4k.

Major economic releases next week are as follows.

The ISM manufacturing index (January) will be published Monday. Manufacturing activity contracted 0.9 points month-over-month in December to 47.2, which is the lowest since June 2009. The index has been in contraction territory for five months through December.

Tuesday brings durable goods orders (December, revised). Preliminarily, December orders for non-defense capital goods ex-aircraft – proxy for business capex plans – rose one percent year-over-year to a seasonally adjusted annual rate of $68.6 billion. This was the second straight up month after four down in a row. Orders peaked at $70 billion last July.

The ISM non-manufacturing index (January) is due out Wednesday. Services activity expanded 1.1 points m/m in December to 55 – a four-month high.

Productivity (4Q19) is on tap Thursday. In 3Q19, non-farm output/hour decreased 0.2 percent. This was the first quarter-over-quarter decline in 15 quarters.

Employment (January) comes out Friday. Last year, the US economy added 2.11 million non-farm jobs, which is healthy but slower than the 2.68 million created in 2018. Post-Great Recession, 21.36 million non-farm jobs have been added.

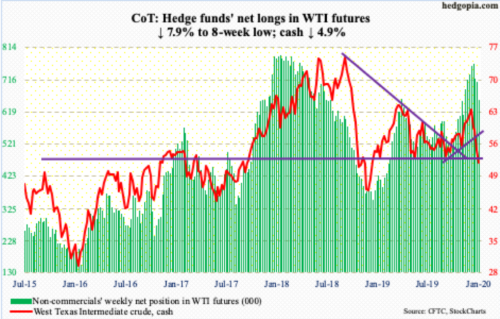

WTI crude oil: Currently net long 654.5k, down 56.4k.

The cash ($51.56/barrel) closed out last week barely hanging on to a rising trend line from December 2018 when the crude bottomed at $42.36. This week began with a breach of that support. Plus, Wednesday’s rally attempt was denied right at the underside of that broken trend line.

Several times between June and September last year, bulls defended $50-51. Friday’s intraday low of $50.97 tested this, which bulls absolutely need to save. Else, bears will be eyeing the December 2018 low.

Bulls did not get much help in Wednesday’s EIA report for the week of January 24. US crude production remained unchanged at record 13 million barrels/day. Crude imports rose 228,000 b/d to 6.7 mb/d. Stocks of crude and gasoline both rose – up 3.5 million barrels and 1.2 million barrels respectively to 431.7 million barrels and 261.2 million barrels. Refinery utilization dropped 3.3 percentage points to 87.2 percent. Distillate stocks, however, fell 1.3 million barrels to 144.7 million barrels.

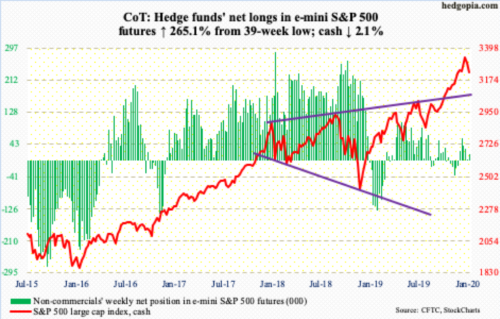

E-mini S&P 500: Currently net long 16.8k, up 12.2k.

Bulls and bears fought for control of the 10- and 20-day moving averages for most of the week before the pendulum swung bears’ way Friday. The session low of 3214.68 found support at the daily lower Bollinger band, which is also just above the 50-day at 3211.30. The cash (3225.52) has not been below this average since early October, so bulls will fight tooth and nail to save this. But odds favor a breach in the sessions ahead. There is a long way to go before overbought weekly conditions are unwound.

In the week to Wednesday, US-based equity funds lost $6.6 billion (courtesy of Lipper). In the same week, SPY (SPDR S&P 500 ETF), VOO (Vanguard S&P 500 ETF) and IVV (iShares Core S&P 500 ETF) together gained $764 million (courtesy of ETF.com).

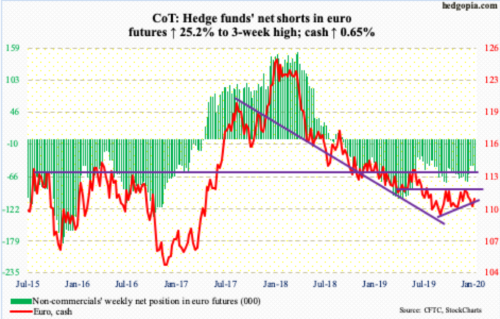

Euro: Currently net short 58.9k, up 11.8k.

Thursday last week when the ECB met, the cash ($110.97) lost a rising trend line from late September/early October last year. This was followed by continued downward pressure – until euro bulls this week stepped up in defense of horizontal support just under $110. A breach would have raised the odds of a test of $108.85, which was the low from last September/October. Near term, the daily has room to push higher.

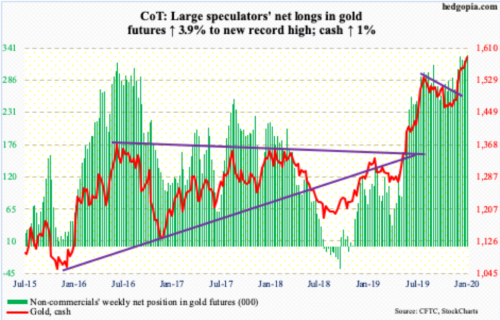

Gold: Currently net long 330.1k, up 12.4k.

Gold-focused ETFs continued to attract money, with GLD (SPDR Gold ETF) taking in $236 million in the week to Wednesday and IAU (iShares Gold Trust) $213 million (courtesy of ETF.com).

In the meantime, non-commercials have accumulated record net longs in gold futures. This bears watching. A stall in the metal can tempt them to lock in gains.

Thus far, gold bugs are probably happy with how the metal is behaving of late. Granted the cash ($1,587.90/ounce) reversed hard after printing $1,613.30 intraday on January 8, but they regrouped quickly. Four sessions after that high, the yellow metal posted a low of $1,536.40 before attracting bids. There was horizontal support at $1,520s. Resistance at $1,550s-60s, which goes back to April 2011, remains massive. In recent weeks, bids are appearing around this level.

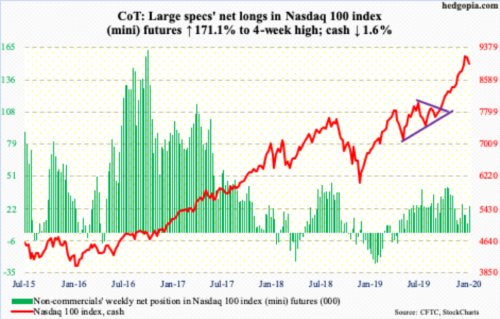

Nasdaq 100 index (mini): Currently net long 24.4k, up 15.4k.

In the week to Wednesday, QQQ (Invesco QQQ Trust) gained $855 million (courtesy of ETF.com), reversing outflows of $2.5 billion in the prior week.

From last Friday’s record high 9272.37 to Monday’s low of 8910.97, the cash (8991.51) dropped 3.9 percent. Like that. Shows how quick nervous bulls are on the trigger. Understandably so given the relentless rally since early October last year. Conditions remain overbought, particularly weekly and monthly.

On the daily, Friday produced another bearish engulfing candle – second in six sessions. More important perhaps is the weekly shooting star this week. There is trend-line support from last October at 8800. In part, Nasdaq shorts may decide whether or not this level holds (more on this here).

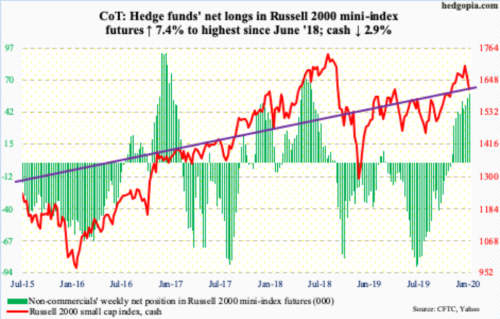

Russell 2000 mini-index: Currently net long 58.3k, up 4k.

Last Friday, the cash (1614.06) lost dual support – one-month horizontal and rising trend line from last October. This likely led to more bleeding out of IWM (iShares Russell 2000 ETF), which lost $843 million in the week to Wednesday. IJR (iShares Core S&P Small-Cap ETF) in the same week attracted $38 million (courtesy of ETF.com). In the prior three weeks, $1.7 billion came out of IWM.

The week opened with a slight breach of the 50-day, with the Russell 2000 straddling the average in the next three sessions but losing it on Friday when it closed right on crucial support just north of 1600. For two years now, this level has proven to be a significant level. The index broke out of it last November, subsequently rising to 1715.08 on January 17. It is a make-or-break.

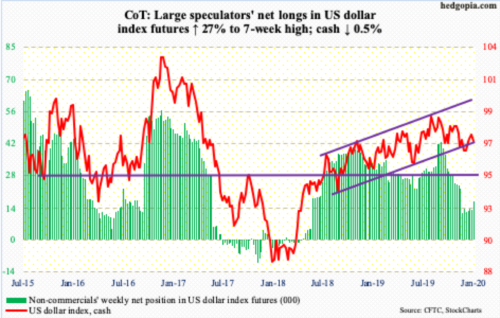

US Dollar Index: Currently net long 16.4k, up 3.5k.

In the middle of the week, the cash (97.21) pushed through a falling trend line from last October, but dollar bulls were unable to hang on to the gains. By the end of the week, the US dollar index was down 0.45 percent.

Friday, the index lost both the 50- and 200-day. The daily is overbought. In a scenario in which it proceeds to unwind its current condition, there is trend-line support from September 2018 at 96.70s.

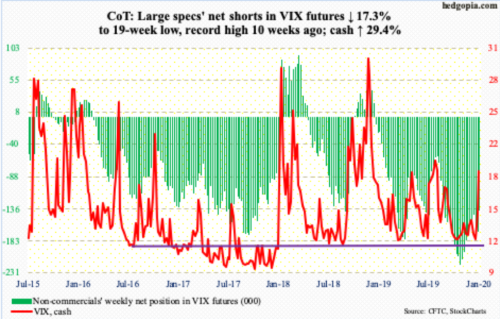

VIX: Currently net short 138.7k, down 31.5k.

The cash (18.84) finally broke through a falling trend line from last August when VIX peaked at 24.81 intraday. As a matter of fact, this resistance approximates a similar trend line drawn from December 2018 when VIX retreated from 36.20 intraday and February 2018 when it printed 50.30 intraday. Hence its significance.

In a favorable scenario for volatility bulls, non-commercials still have sizable net shorts in VIX futures. If past is prelude, the cash does not peak until these traders are either net long or have cut back substantially.

Thanks for reading!